Taps Coogan – January 25th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

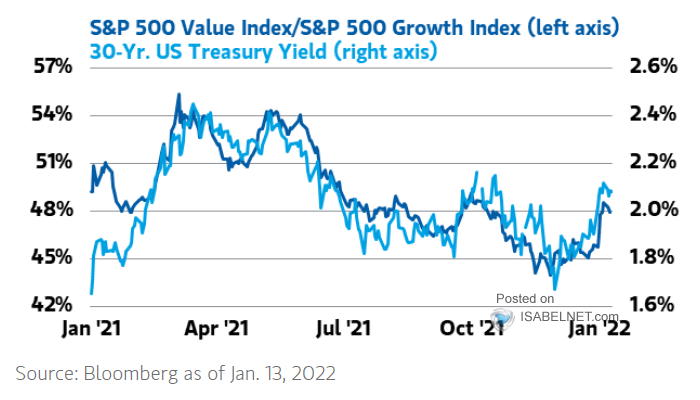

As the following chart from Bloomberg via ISABELNET shows, the 30-year has been a great proxy for the Growth/Value debate for the last year, creating a nice framework to think about stocks if we get further yield curve flattening and growth downgrades.

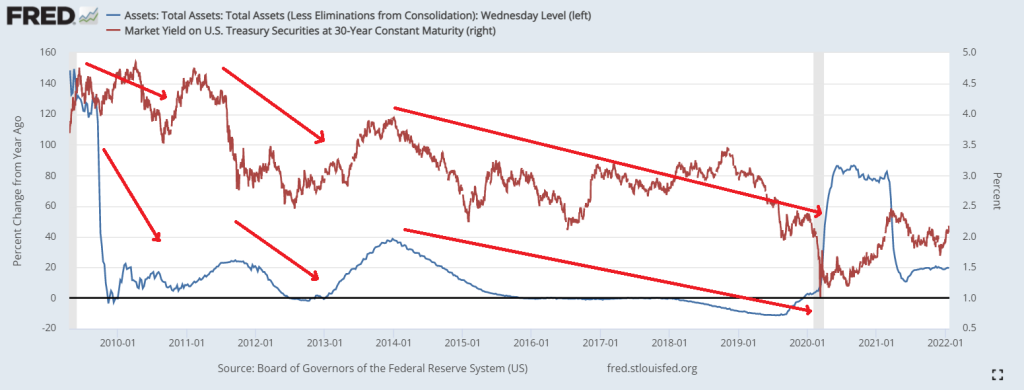

Counter to expectations, long rates have dropped each time the Fed has tapered or ended a QE program.

The net issuance of treasuries in any given year is a lot smaller than the outstanding stock of debt. The risk-off rotation that arises each time the Fed does too much QE for too long and then waits until the economy peaks to tighten has been more of a factor than the fact that they are soaking up less supply, at least for now.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.