Taps Coogan – January 28th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

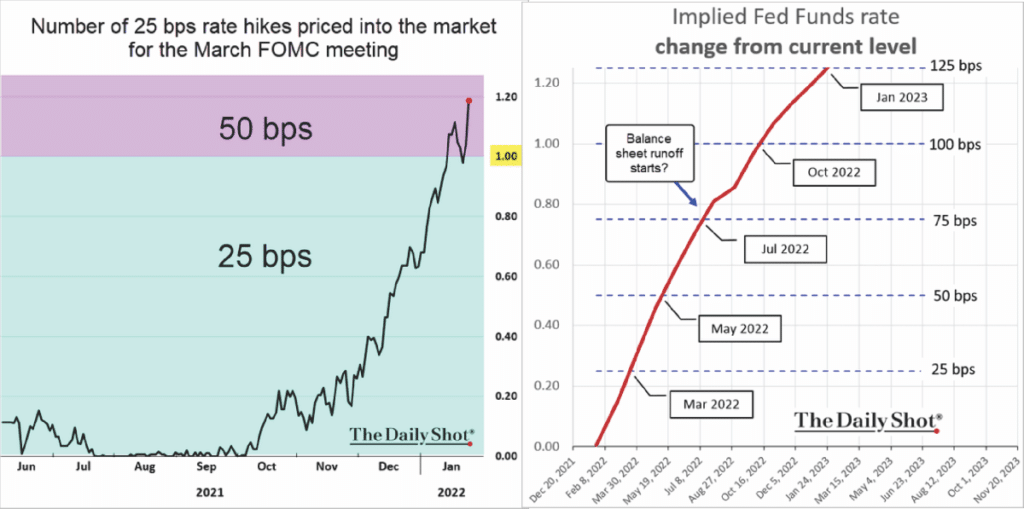

After Jerome Powell’s rambling Wednesday press conference, the market is now starting to price in a double rate hike in March and at least five rates hikes over the next 12 months, as the following charts from the Daily Shot highlights.

Meanwhile, here is the Atlanta Fed’s latest Q1 real GDP forecast. It’s 0.1%.

The S&P 500 had dropped nearly 4% from the start of Powell’s press conference on Wednesday to the lows this morning. Right on cue the Fed has wheeled out uber dove Neel Kashkari to issue the following walk-back:

“A lot of the reason that prices are high right now are temporary factors related to the COVID,” Kashkari said. “The hope is that as the supply chains sort themselves, out some of these price pressures will naturally relieve themselves. And that means the Federal Reserve will have to do less.”

The window for the Fed to tighten policy was last Summer and Fall. It’s too late now and the more they try and force it, the sooner they’ll be pivoting to Not-QE2.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

we’ll pivot back to you on that series of rate hikes