Taps Coogan – February 8th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

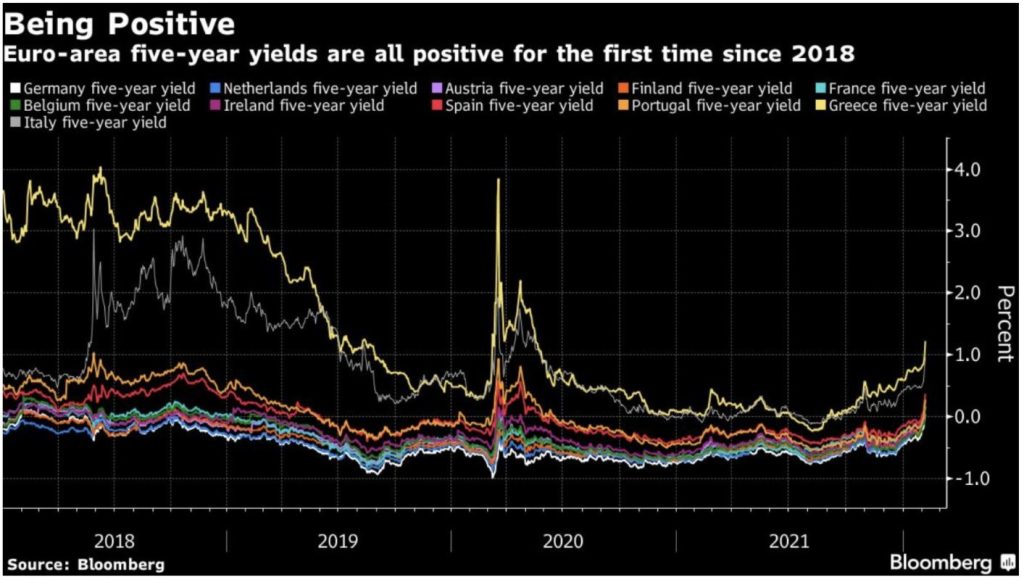

Despite fairly dovish statements from the ECB yesterday, with Christine Lagarde declaring that “There are no signals that inflation will be persistently and significantly above our target over the medium term, which would require measurable tightening,” 5-year sovereign bonds across the Eurozone have surged back above 0% nominal yields for the first time since at least 2018, as the following chart from Bloomberg via ACEMAXX ANALYTICS.

After two-and-a-half sovereign debt crises in the Eurozone over the past decade, the unspoken ‘compromise’ that was hammered out was that the ECB would monetize however much debt was needed to keep borrowing costs negative in real terms while member states would raise taxes.

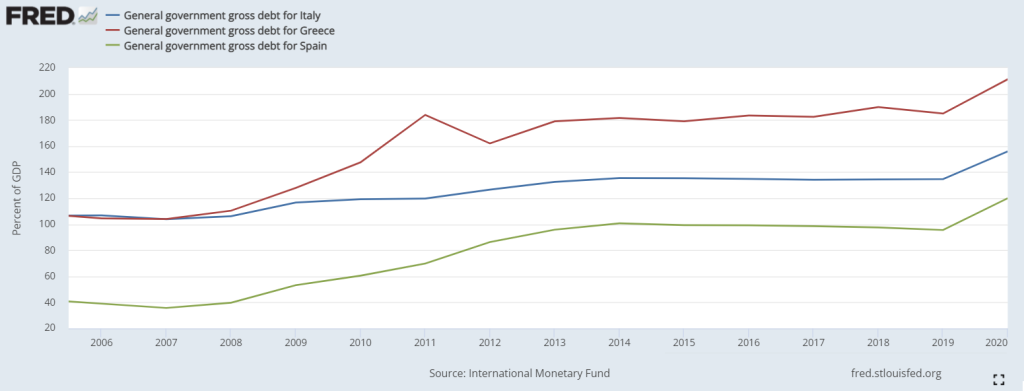

Of course, the fact that the most indebted countries, Spain, Greece, Italy, etc… were already among the highest taxed and regulated countries on Earth should have been a clue that insufficiently high taxes were not the underlying problem.

Nonetheless, that deal was done and, thanks to the ECB, borrowing costs for nearly all Eurozone members at most maturities fell negative on both a nominal and real basis. Of course, because nothing was done to address the actual underlying economic problem, suffocatingly overtaxed and regulated economies with declining populations and bloated public sectors, debt-to-GDP levels kept creeping higher even if the servicing cost didn’t.

Then came Covid and the inflation. Apparently, the suggestion that the ECB may make a ‘non-measurable’ increase in overnight rates later this year, from a negative number to a slightly less negative number, was enough to push borrowing costs for virtually every Eurozone member back above zero for the 5-year maturity.

In the back of everyone’s mind must be the knowledge that if inflation persists and the ECB gets around to actually doing something about it, another Eurozone sovereign debt crisis and/or a recession becomes unavoidable. After all, the one thing that is least likely in the Eurozone is the one thing that it needs the most: anything resembling a more competitive regulatory, tax, and labor environment.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It’s like the entire planetary economy has been captured by the teachers’ union. Bloated budgets, abhorrence of meritocracy, lack of actual goods and services production…..it’s no way to run an market. The entire edifice needs to be deconstructed brick by brick. But that is hard to do when when the general public mistakenly equates supporting such a system with personal virtue. We live under a tyranny of Karens…..

Agreed

ECB, EUROPEAN PARLIAMENT and MATO are just a bunch of criminals. Long live the Deutschmark!!

This has always been the question for me: when will Germany leave the Euro? Their exports have benefited because the euro is weaker than the DM would be, but at some point the German tax payer will get tired of subsidizing the rest. When I say German I really mean the few net-productive countries, but Germany is the biggest. If they do ever even threatent to leave half the rest are immediately broke.