Taps Coogan – February 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The following article is reposted from Visual Capitalist.

Lithium is often dubbed as “white gold” for the development of electric vehicles.

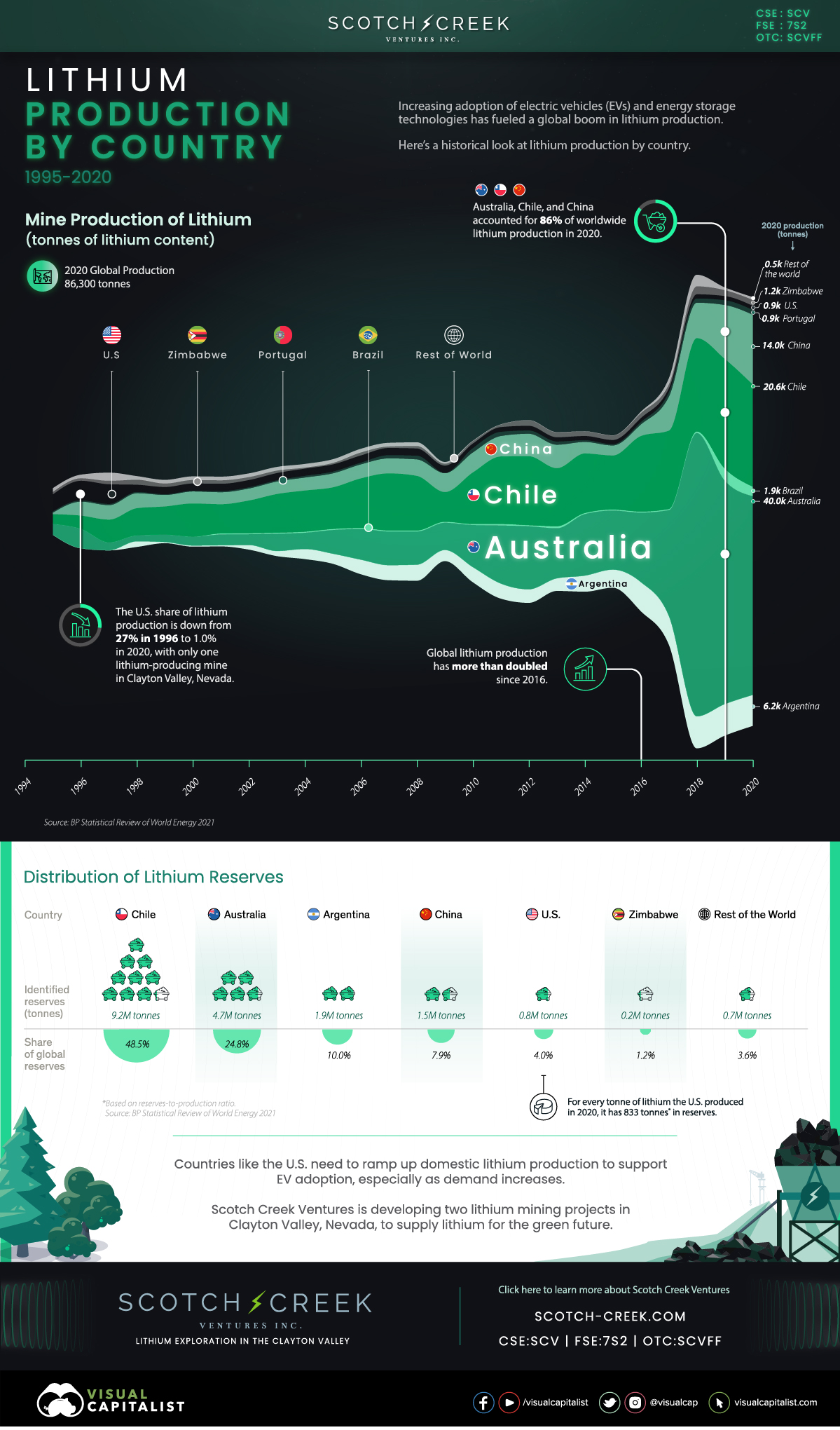

With several countries committed to phasing out new gasoline and diesel engine vehicles by 2040, the recent growth in electric vehicle (EV) adoption has fueled a global boom in lithium production.

For that reason, lithium production more than doubled between 2016 and 2020, up from 40,000 tonnes to 86,300 tonnes.

The above infographic from our sponsor Scotch Creek Ventures charts 25 years of lithium production by country from 1995 to 2020.

A Brief History of Lithium Mining

Countries began producing significant amounts of lithium after World War II, with annual production averaging 5,000 tonnes between 1955 and 1980.

The U.S. was by far the largest lithium producer until 1995, followed by Zimbabwe and Australia. From 1995 to 2010, Chile took over as the dominant producer with a lithium mining boom in the Salar de Atacama, the country’s largest salt flat.

Lithium production grew steadily between 1995 and 2010, up from 9,500 tonnes to 28,000 tonnes. But the advent of rechargeable batteries and electric vehicles brought in a new wave of demand, fueling an exponential production surge.

The Largest Lithium Producing Countries

Today, three countries—Australia, Chile, and China—mine roughly 86% of the world’s lithium.

| Country | 2020 Lithium Production* (tonnes) | % of World Total |

|---|---|---|

| Australia | 40,000 | 46.3% |

| Chile | 20,600 | 23.9% |

| China | 14,000 | 16.2% |

| Argentina | 6,200 | 7.2% |

| Brazil | 1,900 | 2.2% |

| Zimbabwe | 1,200 | 1.4% |

| U.S. | 900 | 1.0% |

| Portugal | 900 | 1.0% |

| Rest of the World | 500 | 0.6% |

| Total | 86,300 | 100% |

*Production total may not add up to 86,300 due to rounding.

Australia’s lithium mining predominantly relies on hard-rock mines that produce spodumene concentrate, which is then converted into lithium. On the other hand, the majority of Chile’s production comes from salar brines with high concentrations of lithium.

China, the third-largest lithium producer, has been on the front foot in the race for lithium. Since 2018, Chinese companies have snapped up over $5 billion worth of lithium mining projects in various countries. Furthermore, the country also dominates the refining and battery manufacturing stages of the lithium-ion supply chain.

By contrast, the U.S. produced around 900 tonnes of lithium in 2020, accounting for just 1% of global production. This is partly because the country has only one lithium-producing mine in Nevada, despite hosting the world’s fifth-largest lithium reserves at 750,000 tonnes (Taps: because it’s now practically impossible to get environmental permits for a new large mining project in the US).

Since 2015, global lithium production has, on average, grown by 27% annually. How will it change going forward?

The Future of Lithium Production

Global EV sales more than doubled in 2021 with 6.7 million new car registrations, bringing the EV market share up to 8.6% worldwide. This growth, in addition to several administrative plans that support EVs, suggests that lithium will likely be in high demand over the next decade.

According to S&P Global, lithium demand is forecasted to hit 2 million tonnes by 2030. This demand would require production to increase by over 2,200% from 2020 levels.

As the need for lithium increases, exploration will play a key role in unlocking new sources of production, especially in countries like the United States, which are currently lagging in the lithium race.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.