Taps Coogan – April 8th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

There have been a number of misleading articles about Russia creating a gold-backing or gold-fix for the Ruble in the last week.

Here is what actually happened.

Before the February 24th invasion of Ukraine, the Russian central bank regularly bought gold.

Immediately after the Ukraine invasion – and subsequent international sanctions, the Russian central bank stopped buying gold.

About a week ago, the Russian central bank resumed gold purchases. They set a standing order at 5,000 rubles a gram for three months, roughly $1,617 per ounce (when enacted).

That’s it.

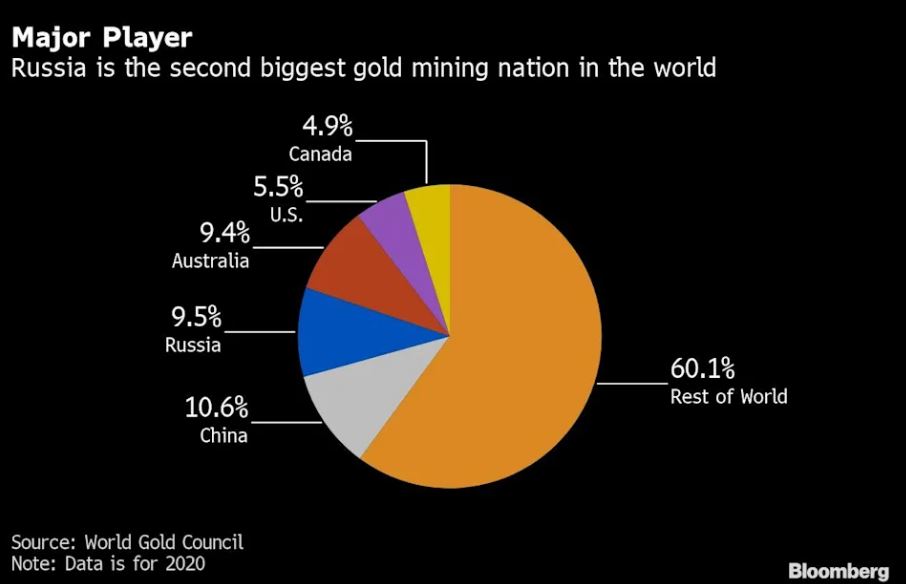

They resumed their purchases after the US imposed sanctions on Russian gold transactions, with the intention of ensuring the “sustainable supply and the uninterrupted functioning of gold producers.” After those sanctions were imposed, Russia’s large gold mining sector was in need of new outlets for the $20 billion-a-year industry, 90.5% of which is exported – with only 10% going to China, as the following chart from Bloomberg highlights.

Many people have falsely compared this to the US Gold Standard prior to 1914.

It’s nothing like that. Under the various US gold standards (and the gold standards in most other countries until the early 1900s) gold was actual money. Paper currency was generally a redeemable voucher for a fixed amount of gold or silver and, to varying degrees, you could go to a bank or the Treasury and get gold in exchange for your currency at the fixed rate. Coins were made of precious metals, e.g. a ‘Silver Dollar.’

Russia has not made Rubles convertible for gold. You cannot go to the Russian central bank (or any other Russian bank) and redeem your Rubles for gold at a fixed price. You don’t know what price that would even be at because they have not pegged the Ruble to gold, or conversely established a fixed gold price in Rubles. The gold price is still fluctuating in rubles. Russian banks and Russian people are still buying and selling gold at market prices.

Again, the Russian central bank has simply offered to buy gold at 5,000 rubles a gram for three months.

It’s not a bad idea, but it’s not a gold standard, a gold-backing, or anything other than a standing order to buy gold for three months.

The move does create a link between the level of Russia’s gold reserves and the gold price, but the link works in the opposite sense as implied by most articles declaring it a ‘gold-back.’ If the Ruble weakens, the Central Bank is likely to buy less gold as the price of their standing-order would fall further below the market rate.

So why has the Ruble strengthened? First things first, nearly all of the strengthening happened before the gold announcement.

It is probably due to a number of factors. First, the selloff was overdone as blood-in-the-street selloffs almost always are. Second, the announcement to demand payment for gas with Rubles pulls FX transactions within their borders – allowing them to accumulate Dollar Reserves away from sanctions, as we explained here. Third, commodity prices have rallied and Russia sells a lot of commodities. Sanctions still don’t directly effect their energy exports. Fourth, they imposed capital controls barring people from sending money abroad and mandating that companies convert 80% of their foreign currency revenues into Rubles. Most critically, they banned foreign currency transactions and withdrawals. In other words, the Ruble exchange rate is now an ‘official rate,’ a rate that domestic Russian and businesses can’t actually transact at in full volumes (versus a real or ‘black market’ rate). We won’t know what the Ruble is actually worth until the transaction bans and capital controls are lifted and private Russians and businesses get a say in the matter.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Author fails to address the VERY real floor, denominated in US dollars, Russia’s ruble-gold link has established AT A TIME WHEN THE Fed Reserve Banksters are talking trash about raising interest rates (trash because they CANT, without breaking the system). As a gold-hoarder (outside the system, in my possession), Uncle Vlad has ended my pain-train, and, should he will it, his move also end the LBMA gold-fix. Rock, at least in this instance, beats paper.

Viewed from the perspective of Gold, yes, Russia’s move is a bid for gold and therefore bullish for gold prices, all other things being equal, at least to the extent that the Russian central bank can buy enough to really matter, and at least for three months. I’ll be publishing a gold related article relatively soon. That’s not what this article is about