Taps Coogan – Apirl 17th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

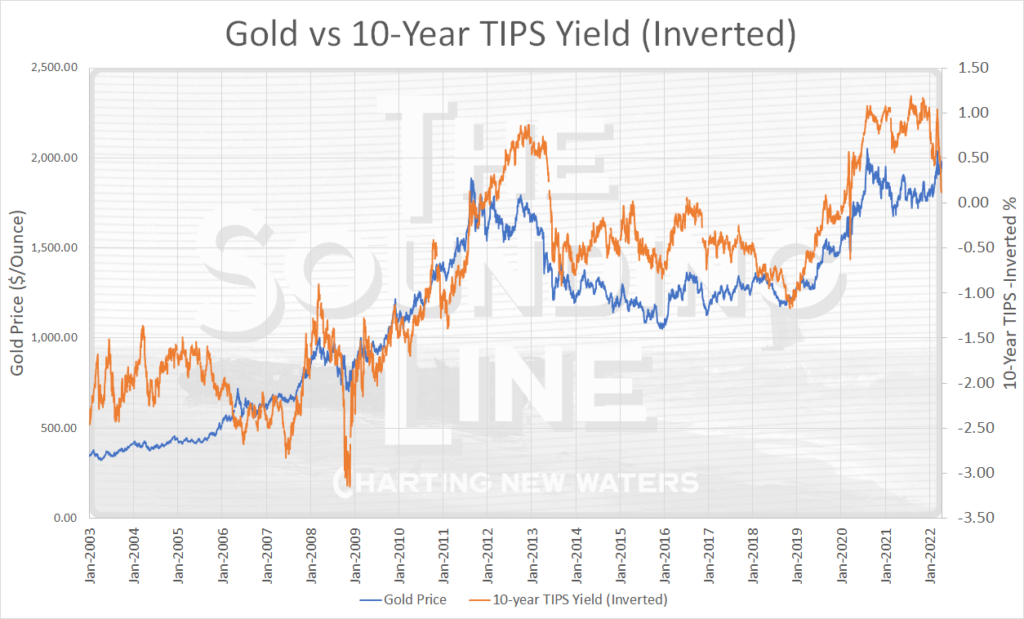

Yours truly has repeatedly pointed out the (inverse) correlation between gold and the 10-Year TIPS (inflation protected treasury) since the Global Financial Crisis.

Why does this correlation exist?

The 10-year TIPS is the true ‘risk-free’ benchmark for the US dollar system. It is backstopped by a sovereign monetary authority capable of printing the money needed to meet the Treasury’s obligations and it is hedged against inflation (CPI).

Gold is also a ‘risk-free’ reserve asset (risk free from counterparty/liability risk, not from an investment perspective). It is also considered to be the preeminent very-long-term store of value. While not an inflation hedge per-say, on a long enough timeline, a store of value and an inflation hedge are roughly the same thing.

However, gold is non-yielding. Gold doesn’t spin off coupons like the treasury market and its price is volatile the short term.

Therefore, the price of gold – a non-yielding reserve asset – can be thought of in relation to the yield on the benchmark long-term, yielding, inflation-hedged reserve asset, the 10-Year TIPS. As the chart above shows, that logic has held up since the Global Financial Crisis.

In a sense, gold has been a price taker from the TIPS market. The more attractive TIPS yields are, the less the need for a somewhat volatile non-yielding asset like gold.

So what?

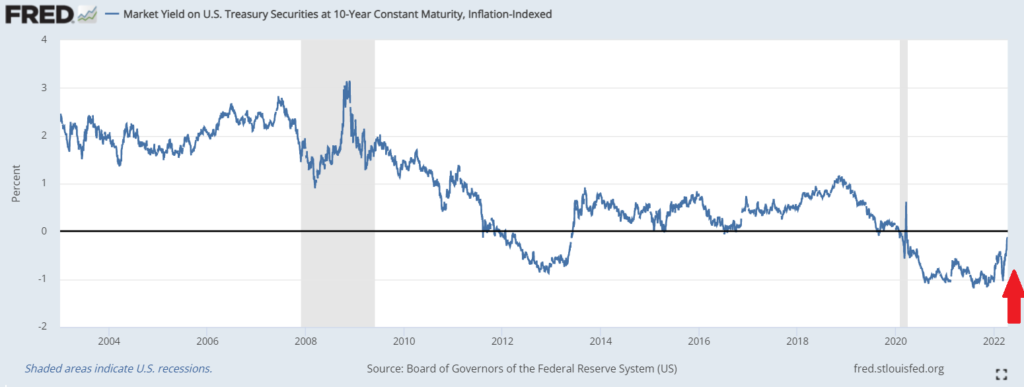

It’s tough to get too bullish about gold if the correlation above holds. The Fed is tightening policy, TIPS yields are close to turning positive again, and inflation will presumably peak on a year-over-year basis sometime this year. All of that looks eerily similar to the setup for the gold bear market that kicked off around 2013. A conventional analysis of gold is pretty bearish.

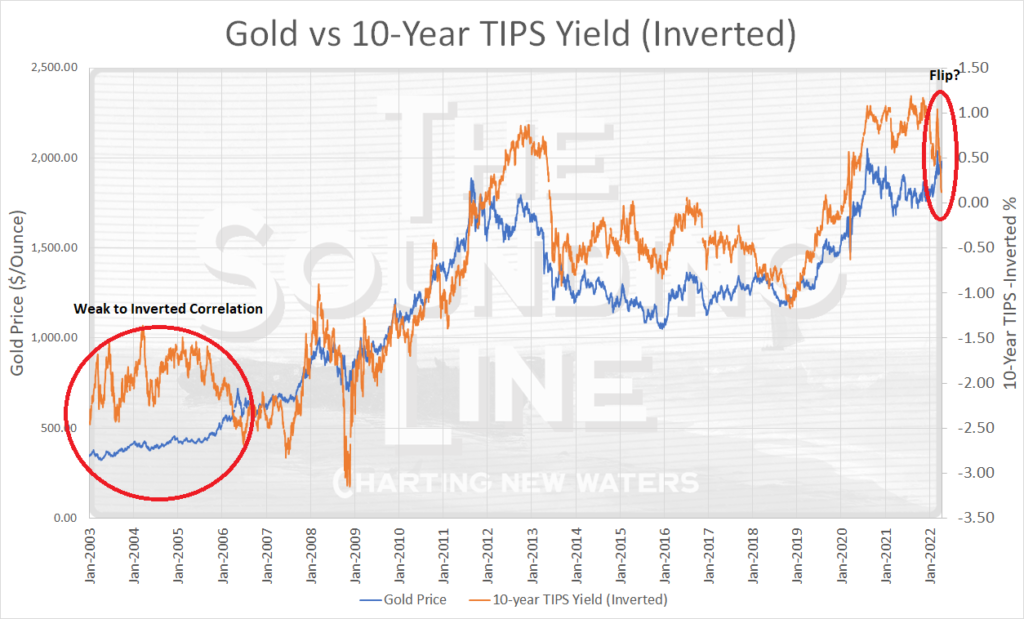

But is the aforementioned TIPS-Gold correlation permanent?

Perhaps not.

Gold’s correlations are famously transient. TIPS have only been around since the late 1990s, but in the handful of years before the Global Financial Crisis, the correlation was much weaker.

The correlation between TIPS and gold presumes an investor’s motivation for gold demand, i.e. a P/L motivation (profit and loss). It also takes the ‘risk-free’ status of Treasuries at face value.

Central bank gold purchases have been muted since the Global Financial crisis, leaving marginal gold demand largely in the hands of private investors. Private investors have a P/L motivation. Hence, we have the correlation that is the subject of this article.

However, unlike private investors, central banks are not motivated purely by P/L. If they come to view the US treasury market as a geopolitical liability (think sanctions), and decide to increase gold reserves at the expense of treasuries for non-P/L reasons, the TIPS-Gold correlation could break down or invert.

On top of geopolitical concerns, the deeply negative real yield across the non-TIPS treasury market is massively unattractive for a reserve asset. Official/central bank buyers of reserve assets are really just looking for long term stores of value.

For a so-called risk-free asset, holders of treasuries stand to lose a lot of purchasing power in the coming years unless inflation drops expeditiously or, paradoxically, yields drop further. While those things may come to pass, treasuries have undeniably become a risky bet if real returns are one’s objective. That kind of trade might appeal to a hedge fund, but not a central bank.

If central banks and other official foreign buyers start to meaningfully reduce their treasury holdings, it may very well invert the TIPS-Gold correlation above. Treasuries may become the price taker from gold, as rising demand for gold pushes treasury yields higher in search of buyers, increasing losses for existing treasury holders and accelerating their desire for gold. Under a sustained inversion of the correlation, the P/L motivation kicks back in with purchasing-power losses being the motivator to drive gold demand.

In the simplest sense, foreign countries want an asset where they can park wealth that preserves purchasing power. For the overwhelming majority of the past 100+ years, treasuries have provided a perfect asset to do this. Not only are you guaranteed to get your money back, you almost always got enough interest to cover inflation and then turn a real profit. The treasury market is ultra-deep and, for the last 40 years, falling interest rates meant you likely had market-to-market gains letting your exit with gains before bond-maturity.

However, non-TIPS Treasury yields are now so deeply negative and a real basis that positive real yields seem like a distant concept. If they do arrive, they will only help future Treasury holders, not existing holders. Until real yields are positive again, which could take years, the logic of the TIPS-Gold correlation breaks down and possibly inverts. Gold is now arguably the only truly ‘safe’ reserve asset and treasury should price off of it, not the other way around.

It’s just a theory, but it’s worth watching.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I’m going to have to read that again when I have not been drinking wine. Can someone give me the readers digest version…..gold might go up in value, of course, ….might go down too…?

Gold might enter a new correlation regime if the default reserve asset switches from Treasuries to gold. There is an argument that this is happening.

I have owned gold for over 20 years and do not consider it an asset class in the traditional sense nor a store of value against inflation. To me gold should be defined as insurance policy against the malfeasance of government policymakers. At some point debasing currency will meet their demise and I feel it is closer than the general investment consensus understands. Lets look at real life example. If you were an Argentina citizen and five years ago you had the same approach to gold as an insurance policy against incompetent policymakers, would you not had been better off?… Read more »

I understand that the TIPS yield may now be coming under incremental suppression. If this is accurate, it makes sense gold price would increase, and the inverse correlation weaken.

Real inflation is 16-20%. It will trigger a recession soon; however, when the Fed lowers interest rates back to zero that will not slow the inflation. Or so Peter Schiff says…

Or so Peter Schiff has been saying since the late 1990s