Taps Coogan – April 30th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

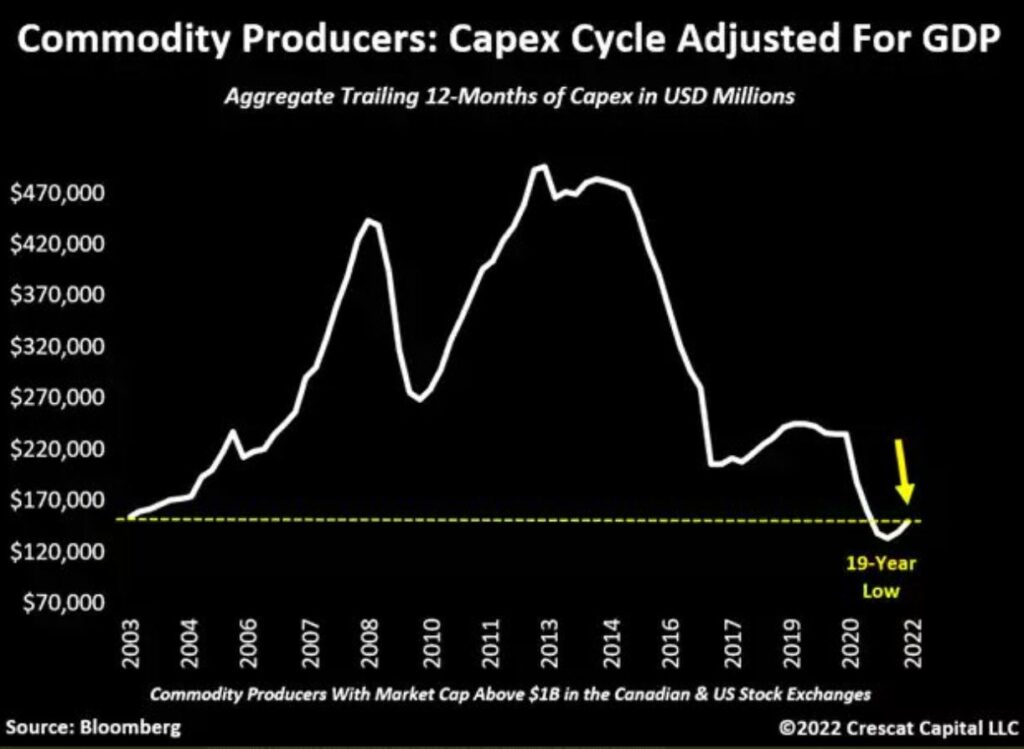

While commodities have had a very strong 18 months, the following chart from Otavio Costa of Crescat Capital highlights that commodity producer capital expenditures, scaled for GDP, are still very low.

The bear market that commodity producers went through over the past decade has led to a deeply engrained hesitancy to use capital, and particularly debt, to increase production.

Major producers’ insistence on using their free-cash flow to deleverage, as opposed to rapidly expanding production, is a sign that an enduring bull market has probably started (and already gotten a bit over-extended), particularly in light of the massive materials intensity of the ‘green-transition.’

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.