Taps Coogan – June 5th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

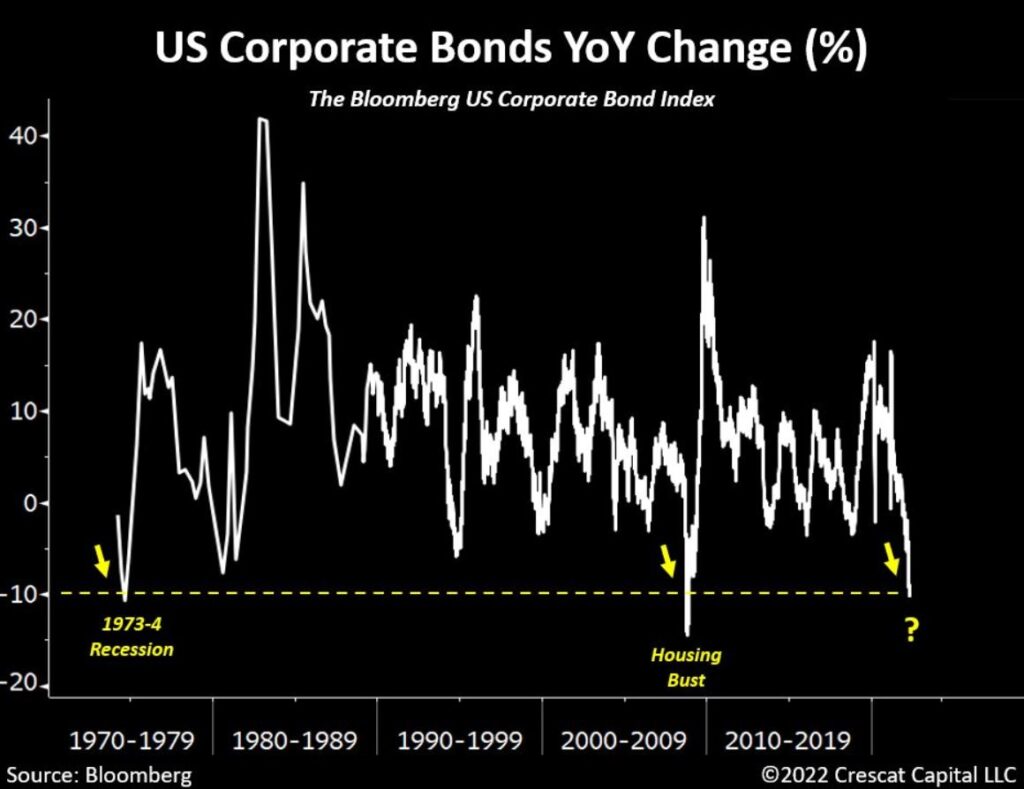

The following chart, from Crecat Capital’s Tavi Costa, shows the year-over-year total performance of the Bloomberg US Corporate Bond Index.

The punchline is that the US corporate bond market has seen its worst 12-month return since the Global Financial Crisis and, in all the various recessions and crashes since 1970, corporate bonds have only really done worse for a brief period during the absolute depths of the Global Financial Crisis.

If you’re looking for an entry point on corporate bonds, it’s time to start paying attention. Of course, with yields on everything down to single ‘B’ junk well below the inflation rate, buyers are taking a bath on real-returns until inflation drops quite a bit, hence the terrible performance.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.