Taps Coogan – June 23rd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

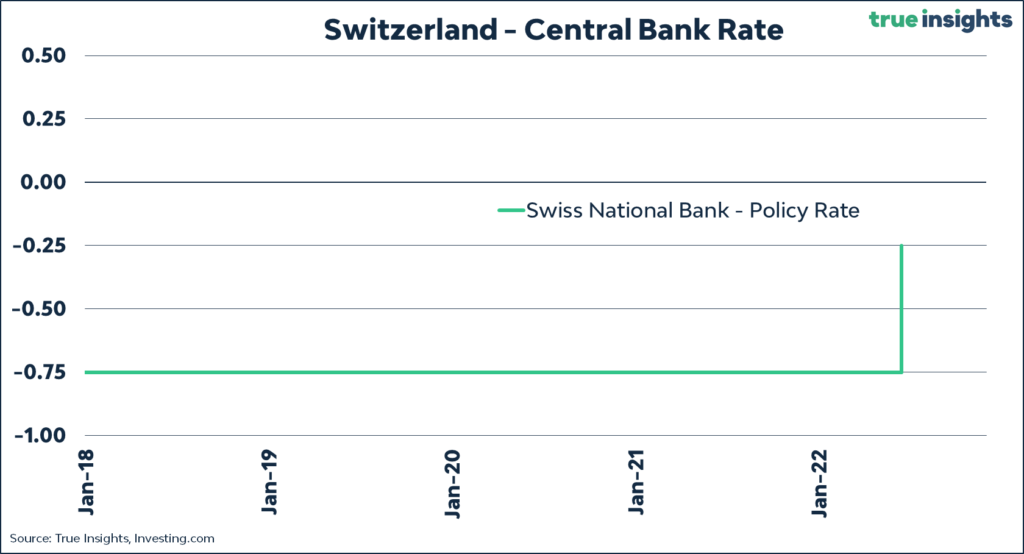

The Swiss Central Bank issued a ‘surprise’ announcement last week hiking its benchmark rate by 0.5% to -0.25%, its first rate hike in 15 years.

The Swiss hike followed an ’emergency’ ECB meeting the same day that many speculated could have seen the European Central Bank raise its benchmark deposit rate above the zero bound after nearly a decade. The ECB ultimately declined to raise rates as it attempts to contain rising sovereign yields across the Eurozone, but pressure remains on them to tighten policy later this summer.

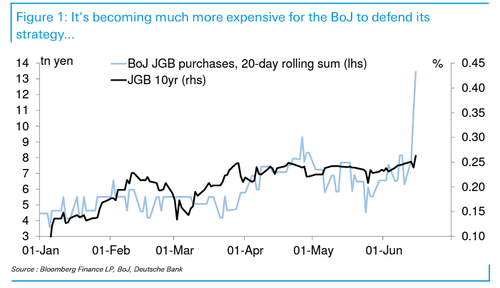

Meanwhile, the Bank of Japan (BoJ) is battling to keep its impossible policy combination of yield curve control, negative interest rates, astronomical debt levels, and endless QE going despite an imploding Yen and rising inflationary pressures.

All of which begs the question: has the bizarre era of negative interest rates finally ended? Was the $18 trillion of negative yielding debt in late 2020 the crescendo of our epic 40 year monetary policy fueled bond bubble?

While it certainly seems so, the shortest path back to more ultra-accommodative policy is exactly the sort of crash that these problems now seem poised to create. Excessive debt, aging/shrinking demographics, and excessively accommodative policy create a self-reinforcing doom loop of slower growth, more debt, and more accommodative policy. While we have broken that loop for now, it has not been because of pro-growth reforms, deleveraging, demographic improvements, etc…

Anything more than a mild technical recession risks returning us back to square one of the Post-Financial Crisis landscape – but worse.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

You pointed out Japan.

But the biggest problem could be the eurozone: countries with very different inflation rates, massively different debts,and one single currency with one single interest rate policy. And now with skyrocketing cost for the gas.

The next BIG financial crisis will come either from China (debt deleveraging) or Europe (fragmentation), in my opinion.

Or both!

Many in Europe will reminisce over the good old days of low cost Russian natural gas and oil products that allowed many industries in Europe to flourish. Germany most of all will suffer and lead the way to normalize relations with Russia. Without a robust Germany, EU is bankrupt

Germany never should have been so reliant on Russian gas in the first place. The solution won’t be crawling back, it will be nuclear