Taps Coogan – July 29th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

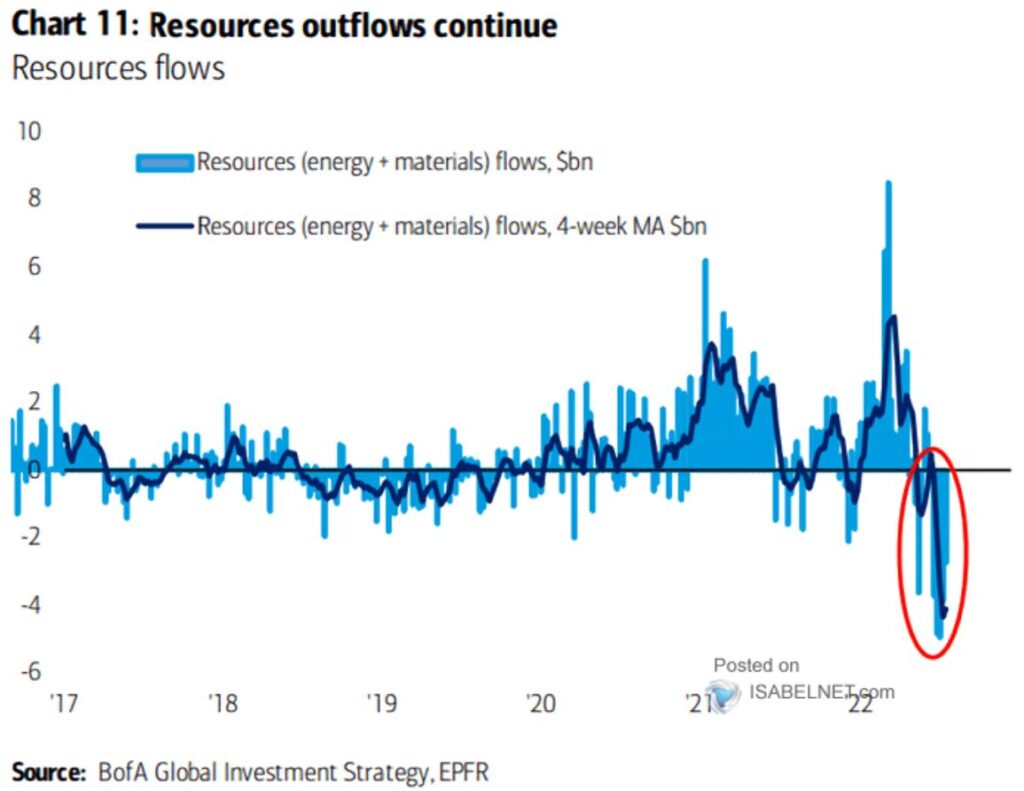

The following chart, from Bank of America via Isabelnet, shows investment inflows and outflows from the resource sector since 2017.

After a couple years of heavy investment, investors have reacted very aggressively to the drop in commodity prices over the past few months and have pulled more capital out of the sector than at any point in the past five years.

As we discussed here, capital expenditures at the world’s largest commodity companies are dramatically lower than they were during the last commodity bull market. Those capital expenditures represent the money used to sustain and increase production of commodities.

For example, Glencore’s capex is down roughly 66% from its peak in 2014, Exxon’s is down 61%, Chevron’s is down 78%, Rio Tinto’s is down 58%, BHP’s is down 70%, Freeport’s is down 72%, etc…

The demand for commodities used in electric vehicles and electricity generation (natural gas, copper, uranium, lithium, nickel etc…) is expected to increase radically in the coming years, requiring massive investments in new mines that is simply not materializing. Market downturns in the commodity space, like the one we are currently going through, are simply going to delay capital expenditures, prolonging the underlying problem: resource scarcity.

The resource scarcity issue may end up getting ‘fixed’ on the demand side, particularly if the Chinese economy enters a structural decline in the coming years, but until then, more production is the only solution.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.