Taps Coogan – August 10th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

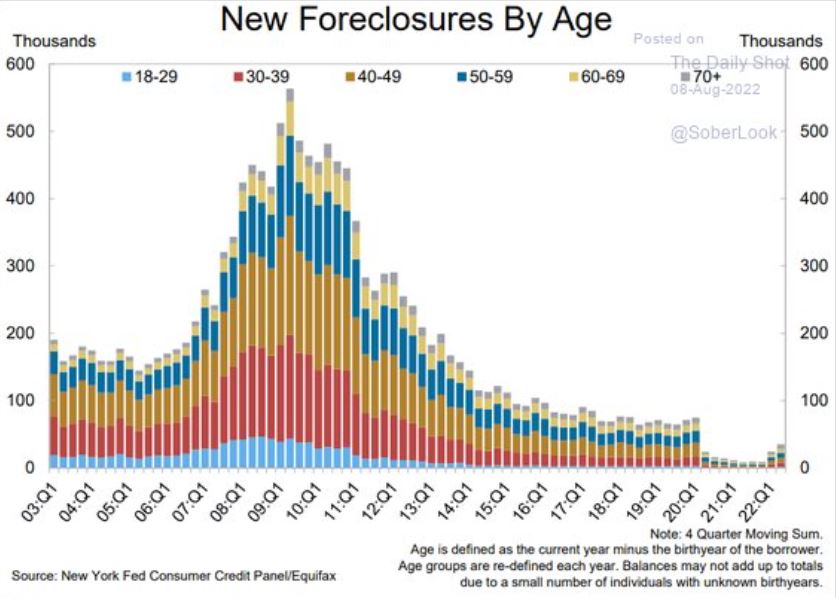

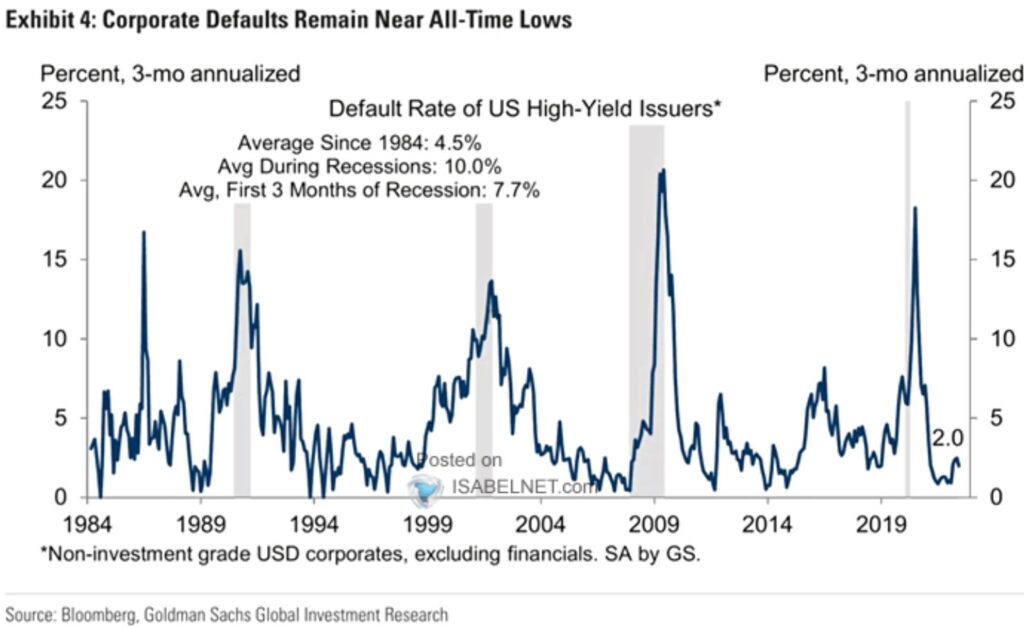

The following two charts, the first via Win Smart and the second via Isabelnet, highlight the same phenomenon: foreclosures and default rates remain historically low.

Both household and corporate defaults/foreclosures have increased relative to last year’s lows but both remain well below long term averages.

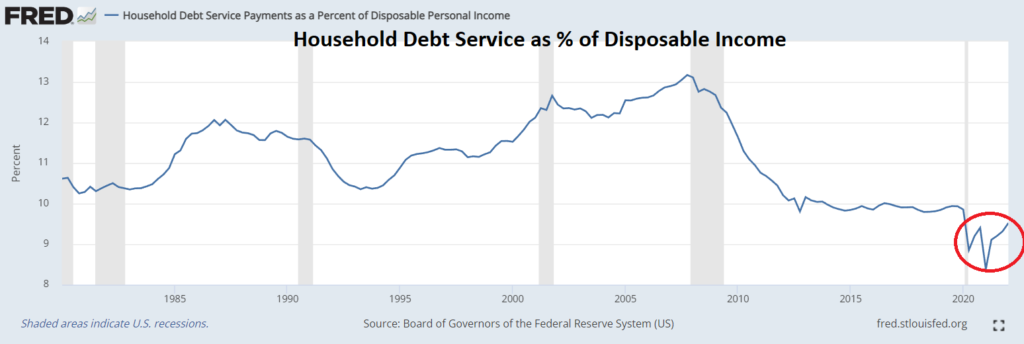

Similarly, household debt servicing costs remain near historical lows as a percent of disposable income and below 2019 levels.

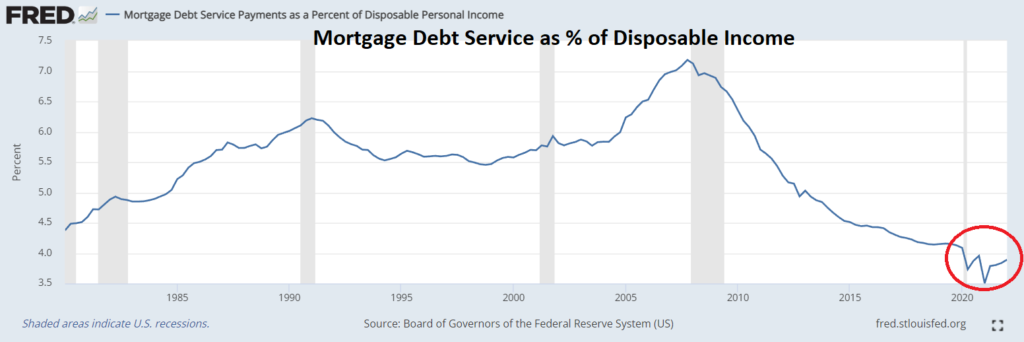

The same goes for just the mortgage component of debt servicing:

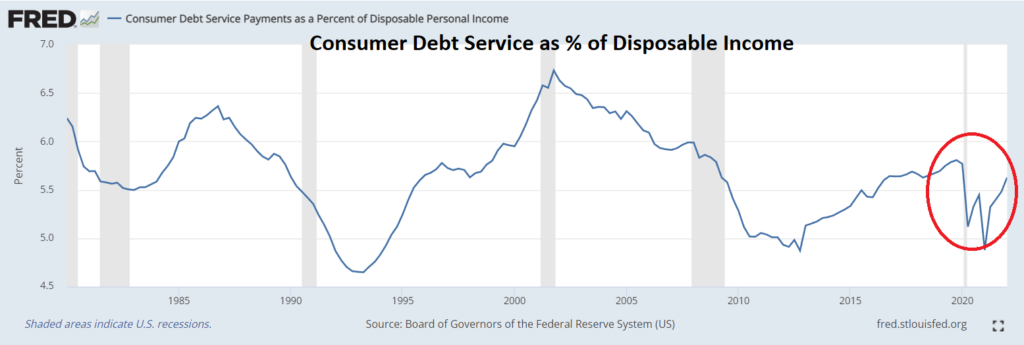

And the consumer debt component (i.e. revolving credit) is also below 2019 levels, though it is the worst looking data set of the lot.

All of these factors will presumably get worse in the coming months but default and foreclosure rates could essentially double from today’s levels and only represent a return to ‘normal’ levels. While that would be bad for the borrowers and lenders involved, and lead to quite a bit of consternation for people looking at year-over-year trends, it would not contain the same information value as would normally be implied by a doubling in default rates.

Indeed, that’s the case for a number of economic statistics from job openings and hires to consumer spending or manufacturing orders. A return to ‘normal’ in those data sets is going to be quite scary looking on a ‘year-over-year’ basis, but we have a long way to go before these data sets look bad on an absolute basis. That doesn’t mean we won’t get there.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.