Taps Coogan – August 26th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Back in June of this year, an explosion at a Freeport LNG facility took roughly 20% of US liquid natural gas (LNG) export capacity offline. The facility isn’t expected to return to operations until November.

Natural gas prices in the US dropped roughly 45% in the months following the explosion as that gas originally destined to be exported to Europe or elsewhere wound up stuck in North America. European benchmark prices have risen nearly 400% since the explosion for a constellation of reasons.

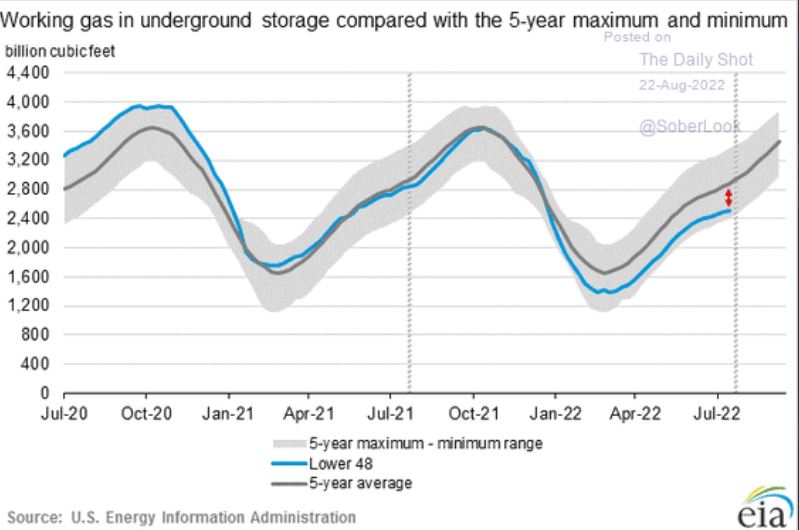

However, a curious thing has happened in the last couple months. Despite a relatively large amount of gas supply remaining in the domestic market due to the explosion, prices in the US have rallied back to new 14-year highs and, as the following chart from the EIA via The Daily Shot highlights, US natural gas inventories are increasingly lagging the 5-year average.

Despite the extra domestic supply, storage is 12% below the historical average for this time of year and prices have rocketed back to new highs.

In other words, this remains a very tight natural gas market and it will presumably get tighter domestically when Freeport comes back online this Fall/Winter.

Regardless of the dynamics of the war in Ukraine, the US is not producing enough gas to keep prices reasonable even with lower exports.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.