Taps Coogan – September 24th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

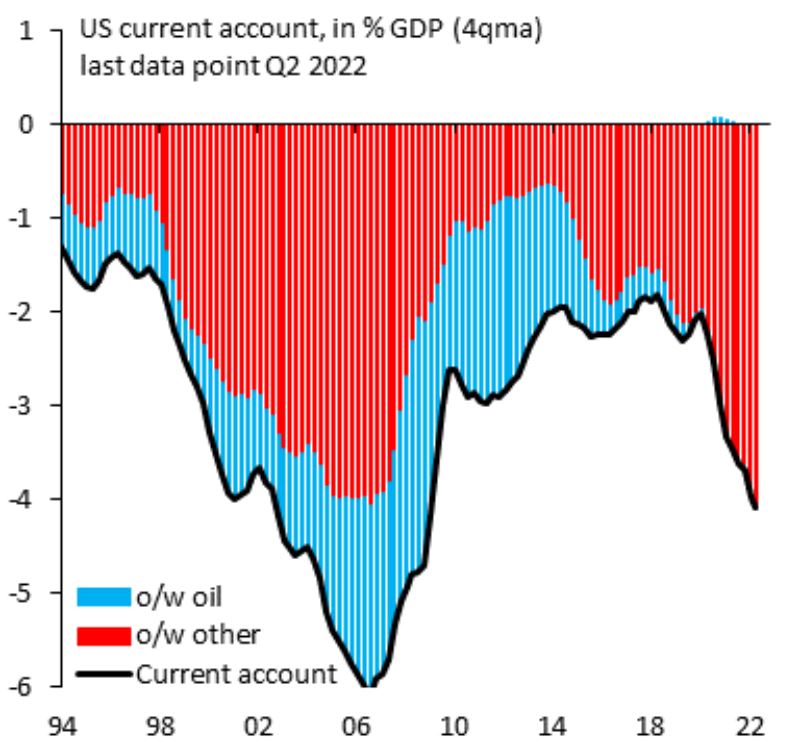

The US current account deficit, a broader measure of the trade deficit which includes financial transfers and payments between countries, has reached it largest level since 2006. When controlling for changes in oil imports, it is the largest level ever, as the following chart from Robin Books highlights.

Economic measures like the current account balance are always a bit ‘leaky’ in that they don’t really capture all the trade and financial flows. Nonetheless, to the best of our ability to measure such things, the the current account deficit has essentially doubled since 2019 as a percentage of GDP.

That hasn’t stopped the dollar from rallying relentlessly over the past year on the back of now-rapidly tightening monetary policy and acute problems in Europe (which makes up +76% of the dollar index).

Whenever the Fed pivots and the recession safety trade into the dollar runs out of steam, the structural headwinds facing the dollar (the twin deficits: trade and budget) are going to be immense.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.