Taps Coogan – October 31st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The following article is reposted from Statista.com:

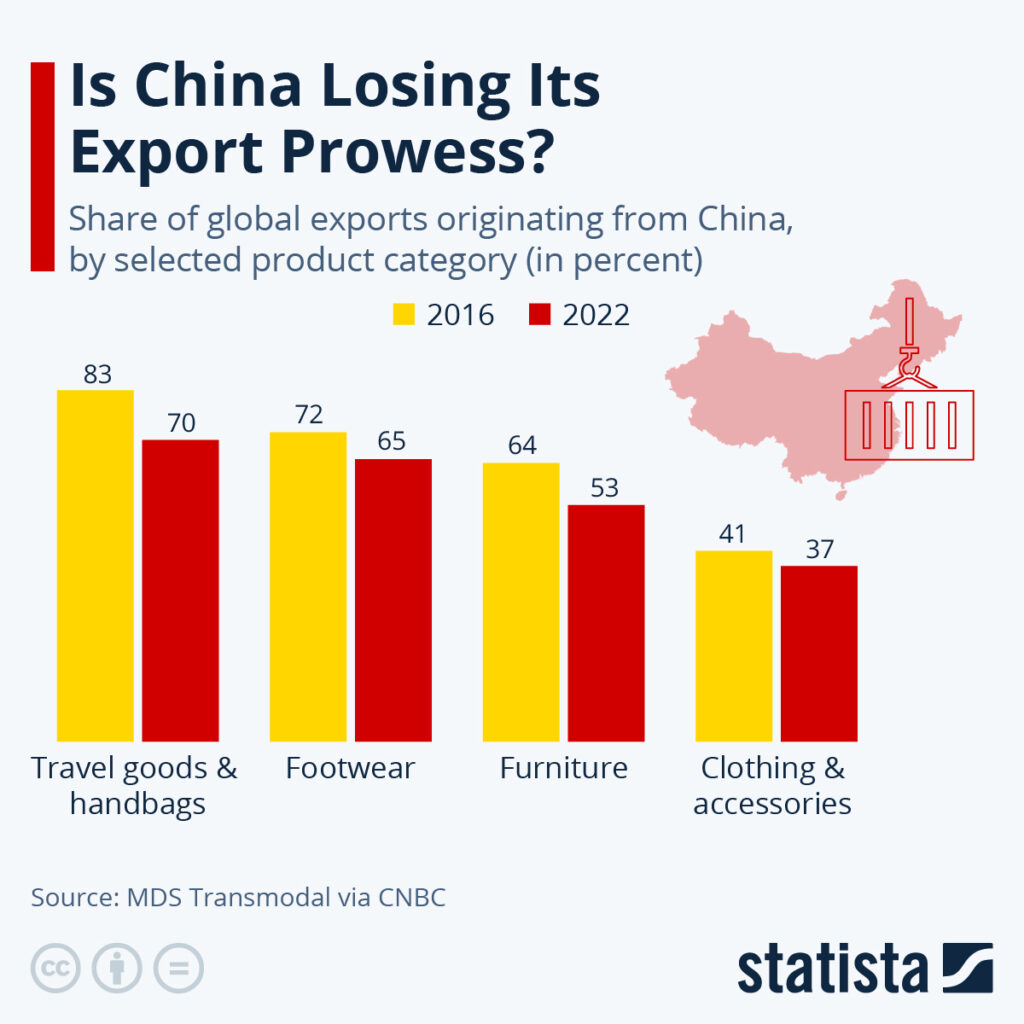

China’s status as the “world’s factory” is not as irrefutable as it once was, data by logistics research company MDS Transmodal published by CNBC shows. According to the figures, China’s share in global exports has been lagging in key categories, like clothing. The development started before the coronavirus pandemic, as competition grew more fierce among producing countries and increased regulation in China saw factories sprout up in locations like Vietnam and Malaysia. Exports further slumped during the coronavirus pandemic as the country’s extensive lockdowns cut production short in many places.

Between 2016 and 2022, China’s share in global footwear and furniture exports decreased by 7% and 11%, respectively. The drop in the travel goods and handbag category was even larger at 13%, but China continues to dominate the segment. The country saw a smaller drop in the important clothing and accessory category, but its export share had also been smaller to begin with, as the market is more fragmented for clothes.

Countries that could grow their global exports included Vietnam, which upped its international sales of furniture, footwear and travel goods by 4% to 9% to shares between 10% and 17% of global numbers, and Malaysia and Bangladesh, which in 2022 reached shares of global clothing exports of 14% and 12%, respectively.

The fact that extensive Covid lockdowns are continuing in China has shaken the trust of the international business community majorly. In a June survey of 117 U.S. companies doing business in China, 48 percent said that Chinese Covid measures have had a severe negative impact on their business. Another 48 percent saw a moderate negative influence. As a result, 55% said they had canceled investments in China and 37% said their revenue projection had decreased compared to 2021. The latter figure is quite close to 2020, when 42% expected revenue losses. According to the report, censorship issues, data protection problems and political tensions between China and the U.S. further complicated the status of China for U.S. companies.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I hope so. But holy crap, looking at that bar chart reminds me of American industrial preeminence during WW2 and immediately after…..and we all know who dominated the world on the back of that dominance. Scary.