Taps Coogan – October 30th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Old Taps is a firm believer that quantitative tightening (QT) is more directly impactful to financial markets than rate hikes. QT is essentially a dollar-for-dollar elimination of liquidity available to financial markets and a dollar-for-dollar increase in the supply of debt that needs to be absorbed by financial markets.

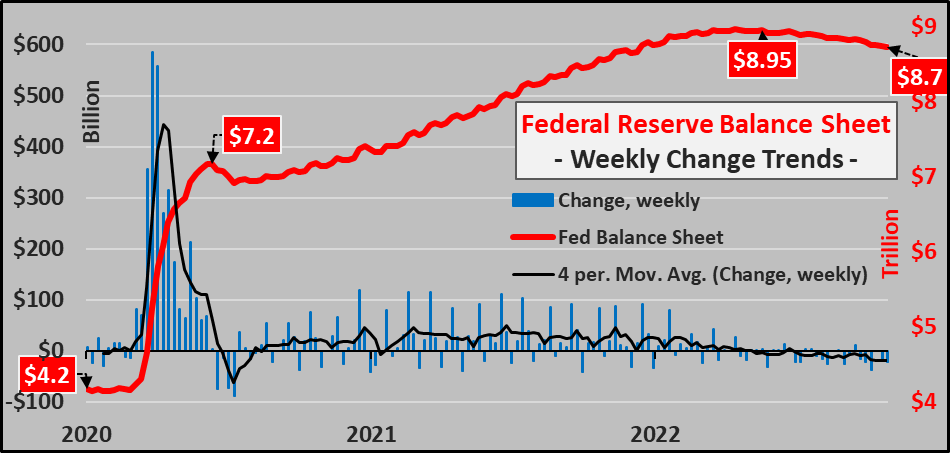

As the following chart from Chris Hamilton of Econimica highlights, despite being 10 months into a bear market and a year-and-a-half into high inflation, the Fed has barely started QT.

The Fed has done about $250 billion of QT. While that might seem like a lot of money, they need to do another $4.5 trillion to get the balance sheet back to where they were before Covid. While that probably won’t happen, don’t doubt that the pressure will be on the Fed to keep draining liquidity for as far as the eye can see.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.