Taps Coogan – December 1st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

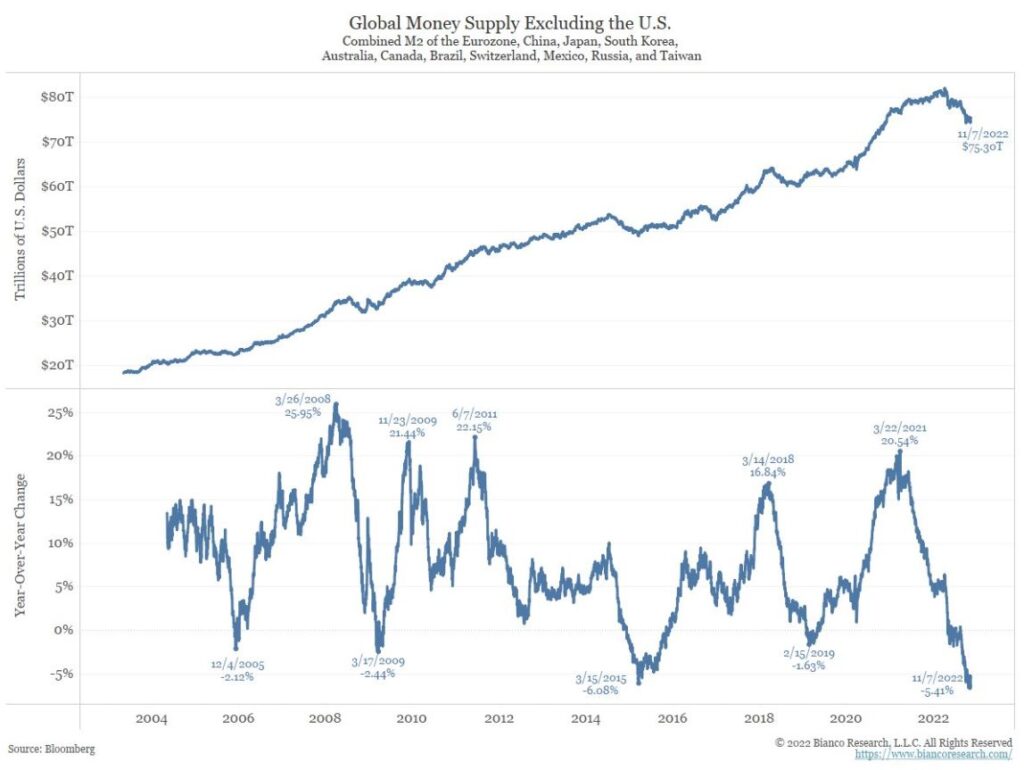

The global money supply, excluding the US, has swung from one of its fastest rates of growth last Spring to its fastest rate of contraction since at least 2004, as the following chart from Bianco Research highlights.

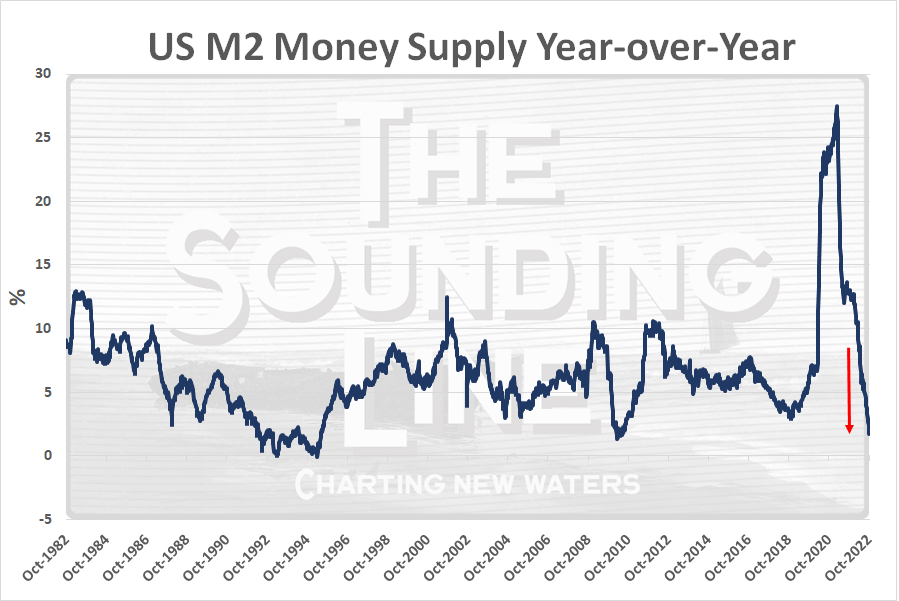

The money supply in the US has started to shrink though is not yet down year-over-year. Nonetheless, the Fed’s pace of $95 billion-a-month of QT is setting up what will likely be the fastest contraction in the money supply since the Fed’s inception.

We wrote numerous articles in 2020 and 2021 warning that the radical increase in the money supply, along with other factors, were going to cause a rise in inflation.

Most indicators are now pointing in the other direction (here, here, here, etc…).

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.