Taps Coogan – December 11th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

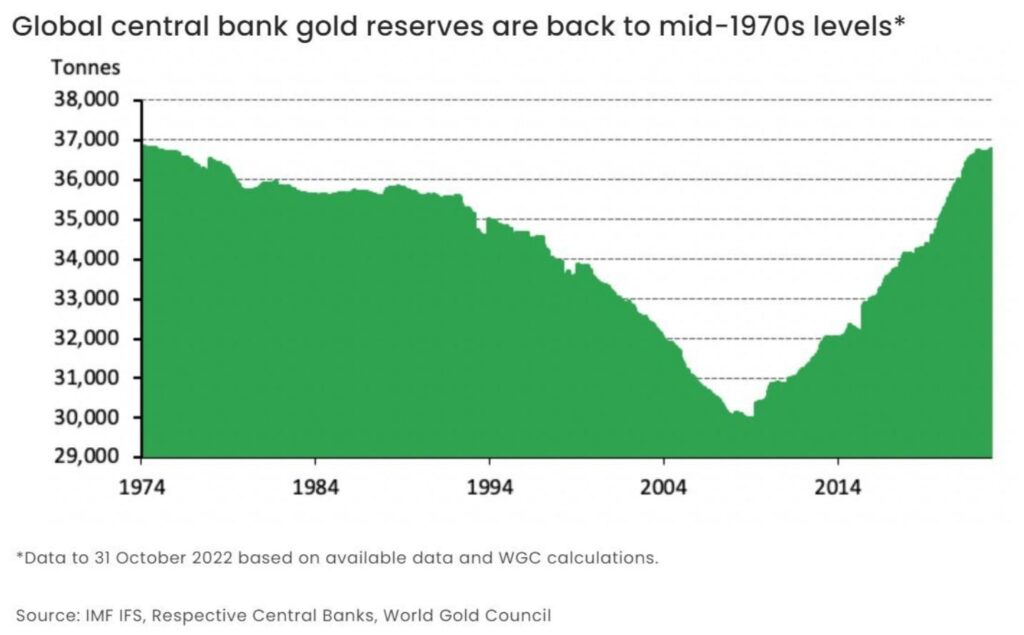

The barbarous relic is apparently back in fashion as global central banks’ gold reserves finally crawl their way back to levels last seen in the 1970s, as the following chart from the World Gold Council via Jeroen Blokland highlights.

China, one of the world’s largest gold holders, infrequently reports its gold reserve levels. As such, they are assumed to be greater than the last reported data.

For the last year or two, we’ve been pretty explicit in our skepticism that gold would do well in an environment with rising TIPS yields. We’ve also been clear that breaking the relationship between gold and TIPS will require gold returning to a more central place in the global reserve system. We’re not there yet, but as the chart above highlights, it’s not inconceivable. If the US finds itself in a recession next year and chooses to do significant fiscal stimulus from the current deficit levels (and with inflation concerns still lingering), we could get ‘there’ fairly quickly.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.