Taps Coogan – December 12th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

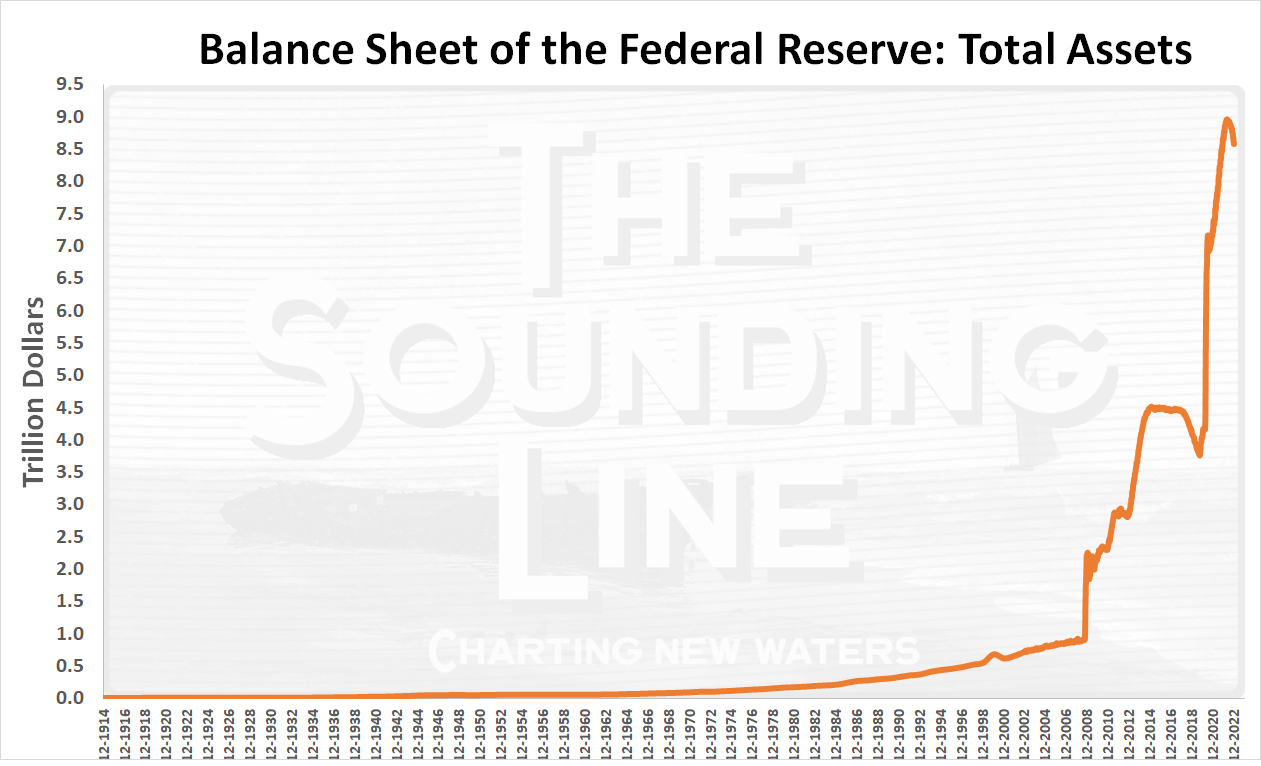

The current pace of quantitative tightening (QT), $95-billion-a-month, has now officially drained $379 billion from the Fed’s balance sheet since March. If maintained for an entire year, this QT program would represent the fastest-ever dollar-value reduction in the Fed’s balance sheet, the fastest reduction relative to GDP on record, and tie the fastest year-over-year rate of change with the recession years of 1949 and 2001.

Despite the seemingly aggressive pace of QT, the Fed has only withdrawn 8% of the liquidity it has injected since March 2020 and the balance sheet is still larger than it was in October, 2021 when CPI first got over 6%.

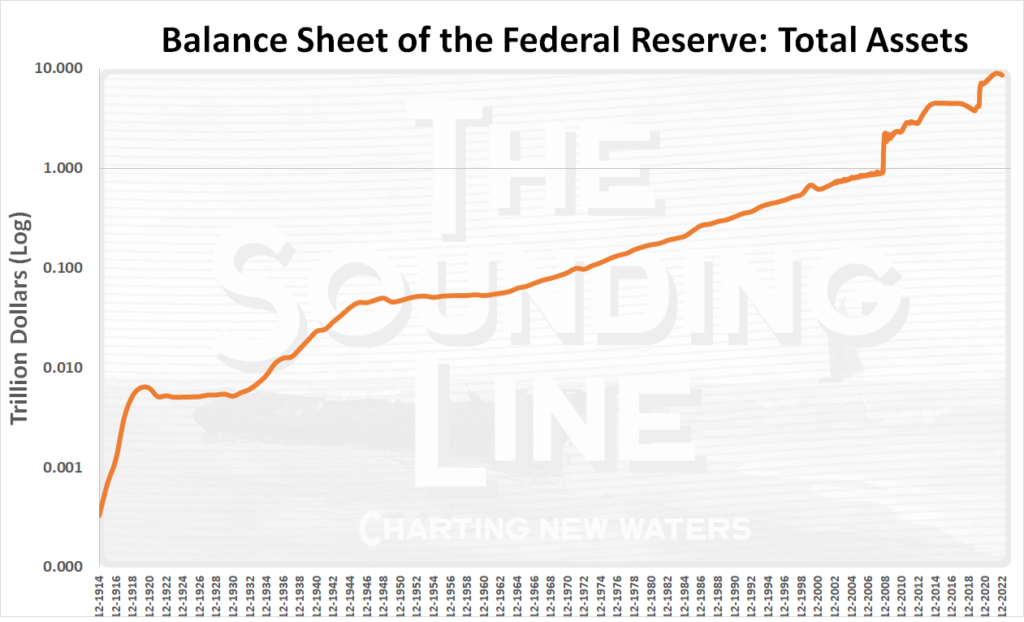

Viewed in log-scale, the reduction is imperceptible. Everything since 2020 has kept us within the stepped up log trajectory we’ve been on since the Global Financial Crisis

Wolf Richter of Wolf Street has estimated that the maximum amount that the Fed’s balance sheet could plausibly shrink based on the Fed’s liabilities. His baseline number was $3.8 trillion and sounds about right.

$3.8 trillion would represent more than three years of QT at the current pace. It would be the largest contraction in the monetary base on record and the only significant contraction to last longer than a year.

We think such a protracted period of contraction in the monetary base is extremely unlikely.

While the Fed has never executed a multi-year nominal reduction in its balance sheet, it has executed two sustained reductions relative to GDP: one after World War I and the other after World War II. The key to both periods was a large reduction in the national debt relative to GDP. The accompanying ‘relative’ reduction in treasury issuance created the space for a ‘relative’ reduction in the monetary base without exacerbating liquidity constraints in the private sector.

Unfortunately, such a sustained decline in debt-to-GDP is highly unlikely. Despite the tax-boosting effects of inflation, tax revenues barely covered mandatory spending in 2022. The entire discretionary budget, which funds every function of government other than entitlements, would need to be eliminated to balance the budget. Not only will that not happen, discretionary spending grew in 2022 relative to the insane stimulus years of 2020 and 2021. Indeed, the CBO forecasts that the budget deficit, as a percent of GDP, will increase every single year after 2023… forever…

To highlight the point further, current budget negotiations between Republicans and Democrats are about whether to increase discretionary spending in fiscal year 2023 by 9% or 10%. The GOP leadership is so worried about being boxed into fiscal conservatism next year that they are actively trying to pass a full-year omnibus deal for 2023 before taking control of the House. Such a omnibus bill would short-circuit any attempt by their own caucus to use their soon-to-be House majority to do they only thing it’s good for: forcing spending discipline.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Tell me “We’re screwed” without saying, “we’re screwed”.

As an encore: Can you briefly describe any future macro-financial paths forward which do not lead to currency collapse?

1) Maybe a war?

2) Technological development of an unlimited, nearly free energy source?

3) A reset engineered by TPTB which somehow is accepted by the populace without extreme social unrest?

….I’m seeing nothing but chaos in our future.

This will never happen but sure there is a scenario: The Fed stops hiking and tapers QT down to a sustainable pace while promising to never do QE again. That easing of monetary conditions moderates the coming recession enough that we can grind our way through it without resorting to ZIRP and more QE. The GOP blocks inevitable calls for fiscal stimulus and shrinks the deficit where it can. Inflation runs above target for a few years, but less than today, and we take the pain. Of course that’s all unlikely, but it could happen. A war could prevent a… Read more »

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcRgufETLG7cpfI0MfWVYjgmNxSSY9TWxIEpXQ&usqp=CAU