Taps Coogan – December 16th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

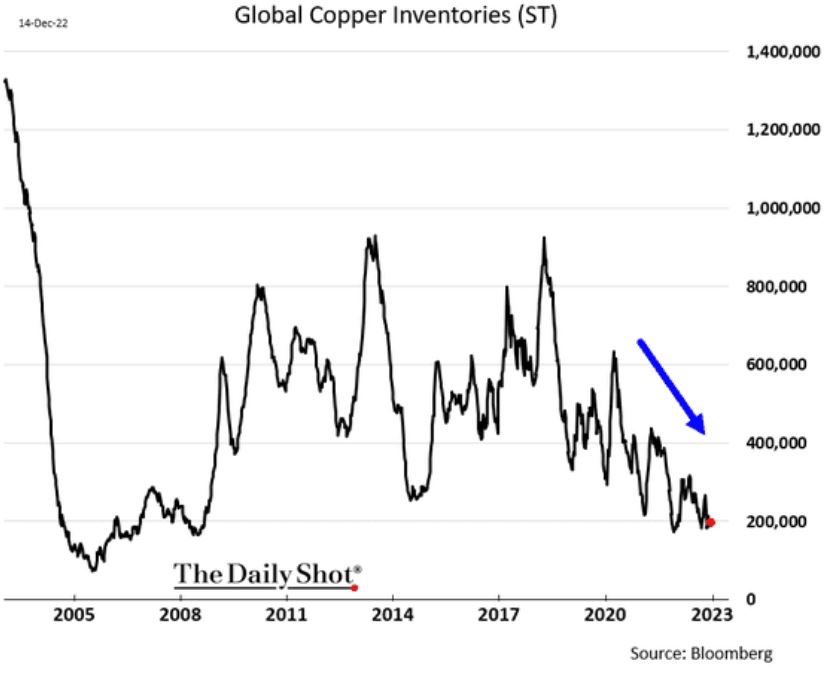

As the following chart from the Daily Shot via Win Smart highlights, global copper inventories remain near the tightest levels since early 2008.

While the high copper intensity of wind power, electric vehicles, and other ‘green’ tech is fairly well documented, today’s copper shortage is more a result of the low capital expenditure budgets of the world’s biggest copper producers. Thanks to the last decade’s copper bear market, capital expenditures at Freeport, BHP, Southern Copper, and Rio Tinto are all down in excess of 50% from the early-to-mid 2010s.

Construction still accounts for roughly half of global copper demand. As such, if we have a global recession, weak construction activity may temporarily free up sufficient copper to relieve the current tightness. Of course, to the extent that a recession suppresses copper prices, it will simply delay the ramp up in miners’ capital investments that is needed to meet longer term electrification and renewable power targets.

While it may not happen on this side of a recession, a protracted period of elevated copper prices seems ultimately necessary and may start with surprising quickness once the storm clouds part.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.