Taps Coogan – December 28th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

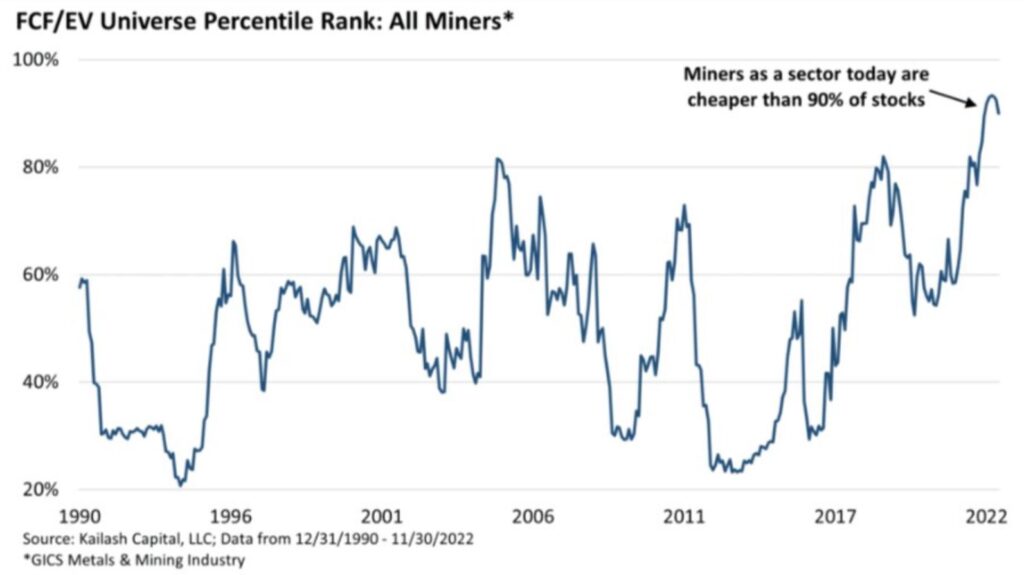

The following chart, from Kailash Concepts, shows that mining companies remain cheaper than 90%+ of listed companies when valued using free-cash-flow to enterprise value.

As we have noted over and over this year (here, here, here), the bear market in resource stocks over the past decade (when everything else was rising to the moon) created a tendency towards very tight fiscal discipline among most larger miners. That discipline is still very much in force despite the recovery in commodity prices since 2020.

The fact that everyone and their dog is worrying about a recession means that mining CEO’s are still sticking to their ‘maintenance’ capex plans despite healthy cash-flows and sparse commodity stockpiles. It also means that investors are hesitant to go into miners despite low valuations and strong financials.

While yours truly has been arguing for much of the year that inflation is likely dropping (and it is), the best argument that we have entered a longer term era of elevated inflation is that the market still hasn’t started allocating enough capital into the resource sector.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.