Taps Coogan – January 25th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

After yield curve inversions, the Conference Board’s Leading Indicator Index is probably the best leading indictor of recessions. It has triggered before every recession since the 1970s with an average lead time of about 7 months. Via TheMacroCompass.com, the following chart highlights that the indicator is clearly signaling a recession later this year.

We are well aware that continuing to warn about a recession is beating a dead horse.

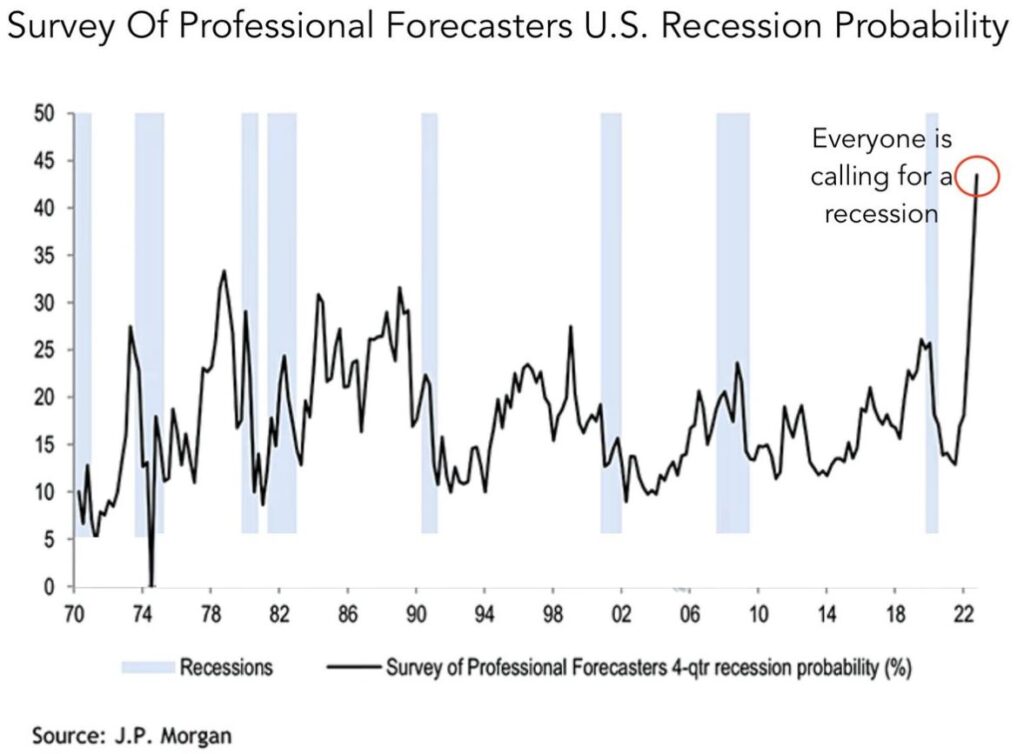

The more interesting question is not whether all the key leading indicators of a recession have fired off (they have), but what it means when everyone sees a recession coming. Indeed, the degree to which people expect a recession is unprecedented at least going back to the 1970s.

We assume that unprecedented expectations of a recession will result in unexpected outcomes. Maybe the recession is already priced in. Maybe it will take longer to arrive than expected. Maybe it will be worse than expected. We don’t know.

Regardless, I’d prefer a recession that people anticipate to one that takes them by surprise. Amid all the doom and gloom, for once, the contrarian outlook is the less-bad one.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I think it’s already priced in and that we’ll languish for a while…