Taps Coogan – February 20th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

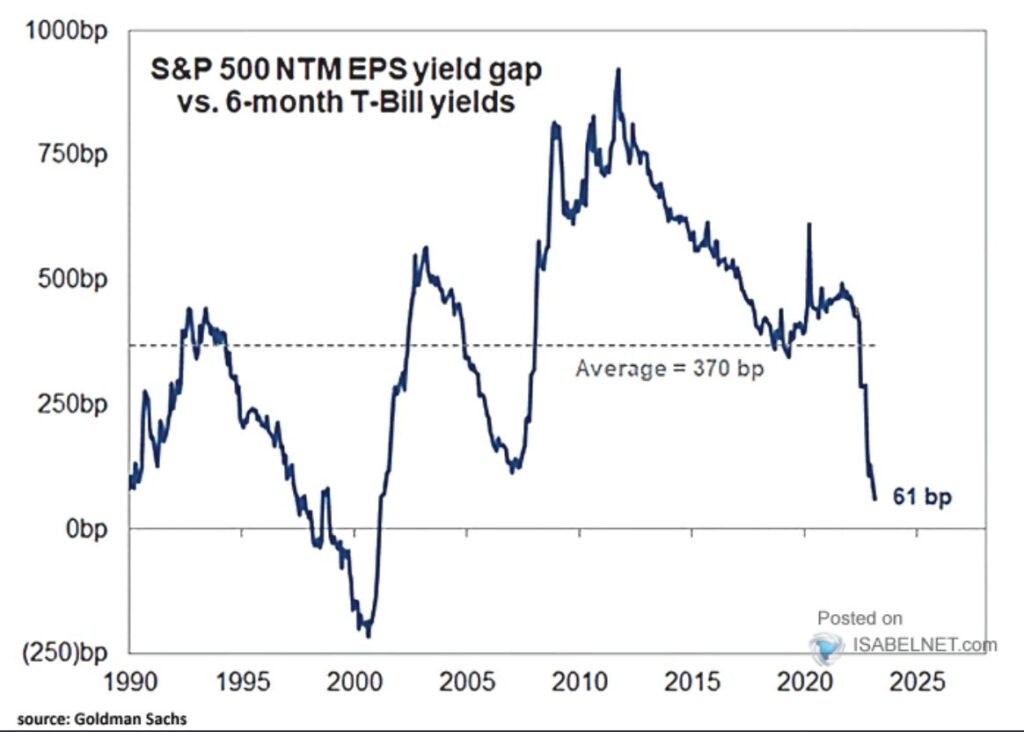

In another sign of just how unfavorable the risk/reward of US equities is, the following chart from ISABELNET highlights that the anticipated earnings yield on the S&P 500 over the next 12 months is just 0.61% above the 6-month treasury bill yield. That’s the worst spread since the eve of the Dot-Com bubble popping.

Given the slew of recession warnings that have fired off over the past year, equity investors are holding quite a lot of risk to pick up virtually no expected earnings yield.

After a year of bearish action, it shouldn’t be a huge surprise that markets have rallied for a few months. Yet, quite a lot of people are starting to allow that rally to change their prior conviction that we were headed for a recession sometime later this year. That change comes without much of a change in the fundamental drivers of the recession forecast; the Fed is still tightening, the money supply is still shrinking, inflation is still far above 2%, etc…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.