Taps Coogan – March 6th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

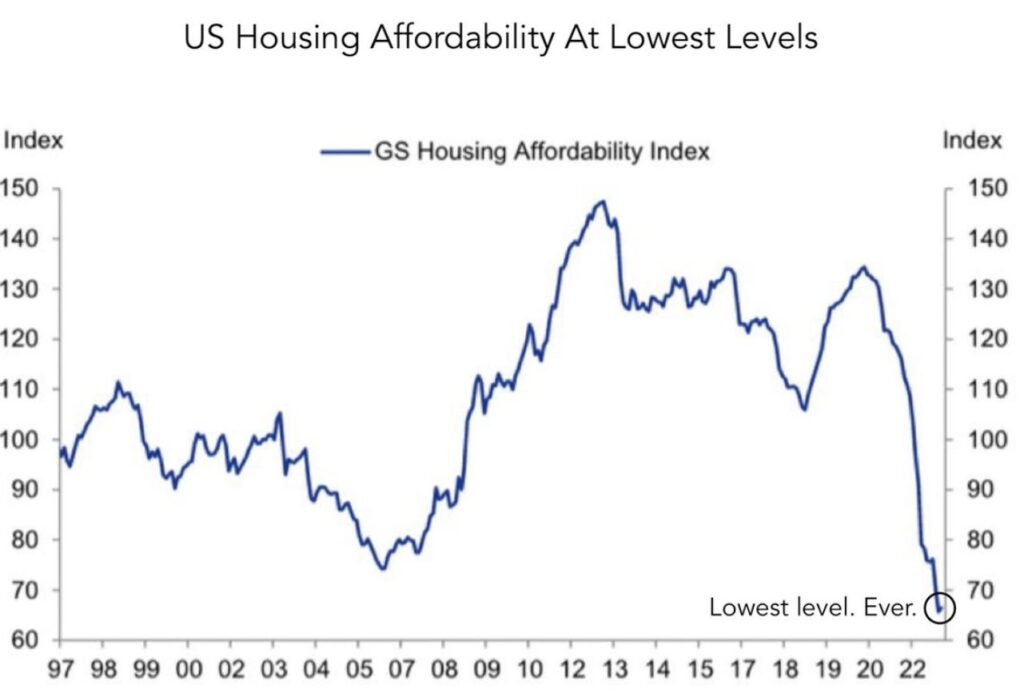

The following chart, from Goldman via Game of Trades, highlights the fact that housing affordability has reached the worst levels since at least 1997.

The fact that housing is less affordable than during the preamble to the Housing Crisis is due to the combination of massive increases in home prices in 2020 and 2021 followed by massive increases in mortgage APRs in 2022.

Nonetheless, as we noted yesterday, 99% of outstanding mortgages are at rates well below today’s APRs. That means that while affordability is extremely bad for new home buyers, people with mortgages written before Spring 2022 are largely unaffected.

This is not a redux of the 2008 Housing Crisis but something slower moving. Existing home owners are very strongly incentivized to pull existing homes off the market, dragging out the home-price correction dynamic.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.