Taps Coogan – March 22nd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The following article is reposted from Statista.com:

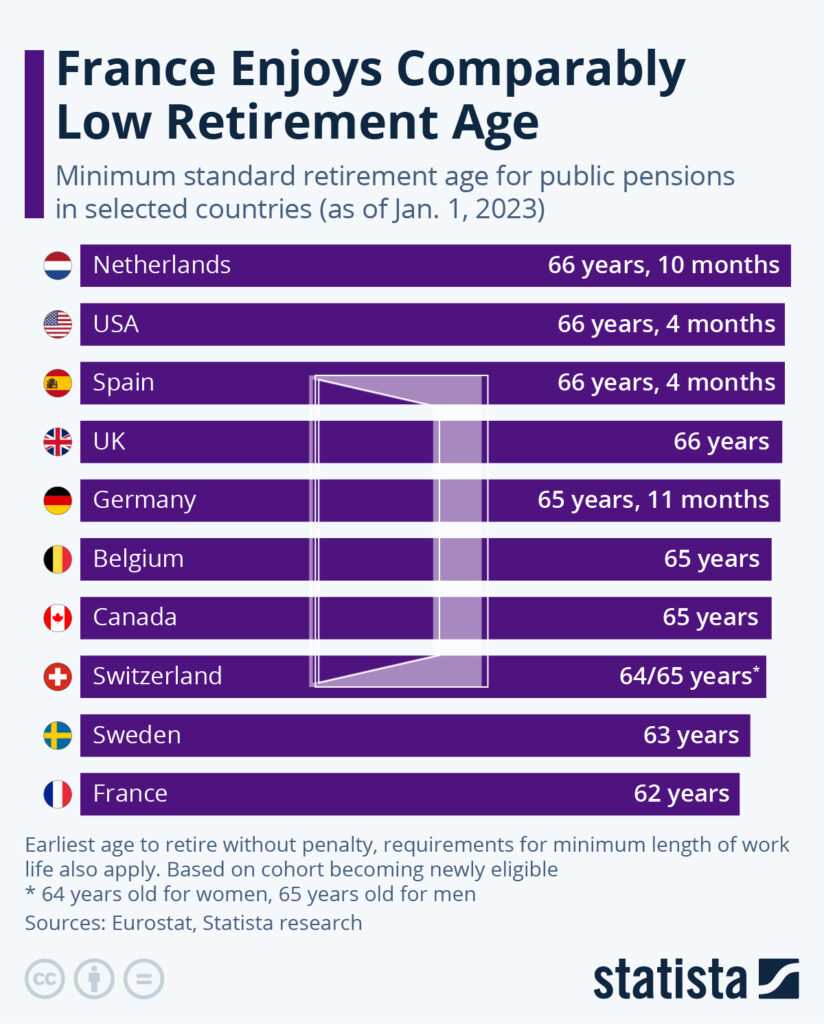

Protests and strikes that have disrupted France for weeks have grown more intense after the government yesterday decided to force through a controversial reform raising the minimum standard retirement age from 62 to 64. The change has been in the making for years and has been postponed time and time again following fierce opposition among the population – for example in the form of the country’s longest-ever transport strike in early 2020.

French President Emmanuel Macron will evoke special constitutional powers to pass the law that the French Senate on Thursday signed off on, but that was expected to hit a roadblock in the lower house. French Prime Minister Elisabeth Borne, who announced the plan, called the reform necessary to prevent a major deficit in the pension system. Like many aging societies in Europe, France is looking to support a growing share of retirees among its population, but unlike many of its neighbors has not raised the retirement age so far.

The change is scheduled to be finalized by 2030. Likewise, other developed countries around the world have been in the process of raising the retirement age of their public pensions, but most have gotten a lot further than France will have come in this decade. The Netherlands, Spain, Germany and the U.S. (through the Social Security Administration) are inching up to their joint new retirement age of 67. The newest cohorts eligible for a standard pension as of January 1, 2023 are now between 65 years and 11 months and 66 years and 10 months of age in these countries. The new retirement age of 67 for newly eligible cohorts will be reached between 2024 and 2030. The UK, meanwhile, will start inching up to 67 between 2026 and 2028, while Belgium will raise the minimum retirement age to 66 in 2025 and 67 in 2030.

In addition to an age requirement, countries also apply minimums for the length of a person’s work life in order to retire with a standard pension. Exceptions are sometimes made for people who majorly overshoot that work life requirement ahead of minimum pension age. In most countries, it is also possible to retire from an earlier age and accept deductions. Diverging rules apply to occupational pensions, basic benefit pensions, individual pension accounts and of course, private pensions.

Countries that have been more timid in raising the retirement age include Canada, where plans to change it beyond 65 were scrapped, and Switzerland, which is still mulling a further raise. However, the retirement age will be 65 for both sexes starting in 2025 in the country. Sweden raised the retirement age to 63 this year from 62 and might increase again as life expectancy rises.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Not a big fan of Macron, but you gotta give him credit for doing this given the French capacity for temper tantr….er, I mean protests. This is going to become more and more of a problem across the developed world as the effects of low birthrates really kick in leaving too few workers paying into the system. Welfare state, indeed.

Well put

Tax more enterprises, wester society are fucked up, the idea that both parents have to work bring automatically less children.. In Italy you already need to be 67 to get retirement

Taxes on enterprises are taxes on everyone, just another cost for businesses, not really different from higher rent, higher input prices, higher energy costs, etc… Corporate taxes are reflected in end prices going up, consumption going down, or activity levels falling. No such thing as a free lunch