Taps Coogan – March 27th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

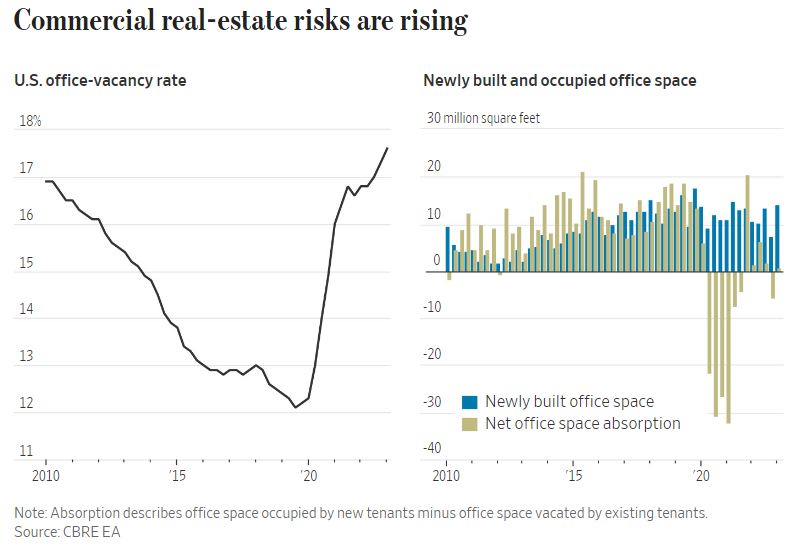

The following chart, from the Wall Street Journal, highlights the fact that the US office vacancy rate continues to deteriorate despite the ‘back-to-office’ trend.

Even though workers have come back to the office in many industries, the return rate is not 100%. Leases signed before Covid are still being rolled into smaller footprints. On top of that, the supply of new office space today still largely reflects projects greenlit before Covid.

As the Wall Street Journal notes “small banks hold $2.3 trillion in commercial real-estate debt, according to Trepp Inc., or roughly 80% of commercial mortgages held by banks.” Add that problem to the reality that banks are going to have to pay depositors something resembling a real rate if they want to hold onto deposits in a world where you can get >4% in a Treasury money market fund.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.