Submitted by Taps Coogan on the 25th of July 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

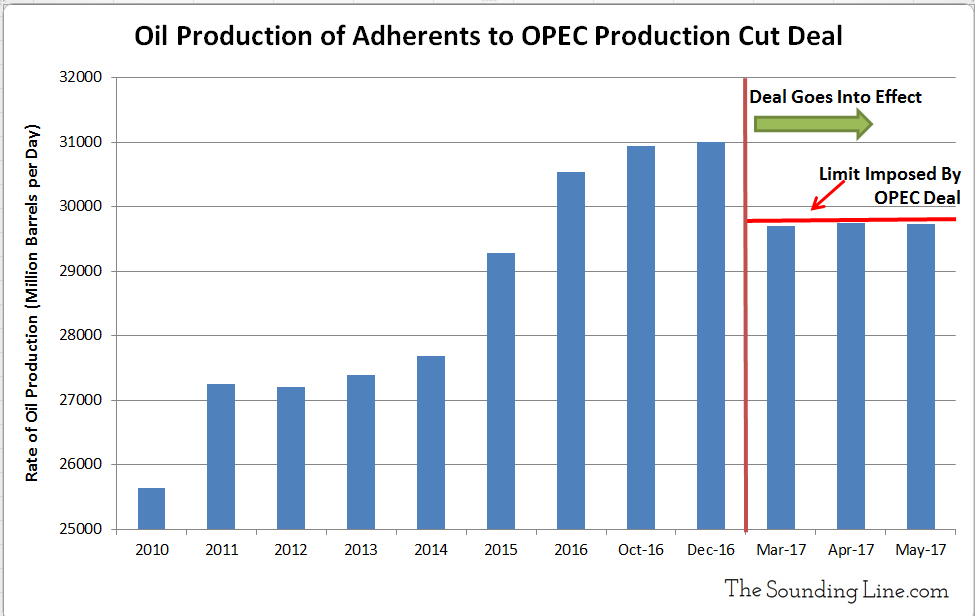

In our recent article Why the OPEC Oil Cuts are Failing to Support Higher Prices, we presented the following chart, which shows that the 11 OPEC members who agreed to oil production caps were, as of the latest data in May, holding to their commitments.

However, as we noted in that article:

“These production cuts have been undermined by surging production by the two OPEC members who are not adherents to the deal (Libya and Nigeria), who together have added over 460,000 barrels per day of production compared to 2016. This has made the just over one million barrel per day of claimed OPEC cuts really just a 640,000 barrel per day once accounting for Libya and Nigeria. To make matters worse, oil production outside OPEC has been rising with the US alone having added over 660,000 barrels per day of oil production so far in 2017.

The net effect of this is that the OPEC oil production cuts have been offset by increased production in Libya, Nigeria, and the US.”

As a result, oil markets have failed to meaningfully reduce oversupply and thus prices have failed to rise. It also implies that the ultimate result of OPEC’s oil cut agreement has simply been to transfer market share from OPEC members who agreed to cut, to the rest of the world, mainly the US. That is not to the advantage of OPEC.

OPEC has been an all-important fixture in oil markets and oil prices for decades based on the idea that it controls enough of oil production capacity to effect market supply and prices. If the result of OPEC oil cuts is only that it permits other producers to take market share, OPEC serves its members little practical utility.

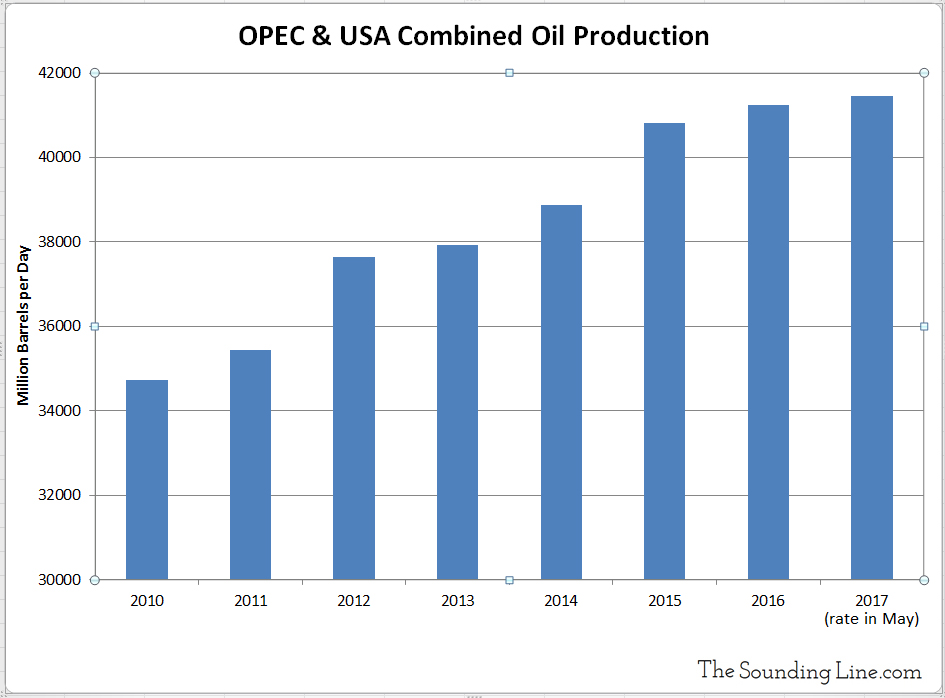

To illustrate the point that OPEC’s oil cuts have been completely offset, the following chart shows that combined OPEC and US oil production in 2017 (as of May) is higher than it was in 2016, despite the OPEC production cuts.

If OPEC wants to re-assert control over markets, it will have to cut its production by an amount larger than the swing capacity of all non-adhering countries. That OPEC has not already done this suggests that its member countries cannot risk the cash flow, a problem that is unlikely to get better anytime soon.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.