Taps Coogan – June 29th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

As the following chart from the Game of Trades highlights, the 10-year/3-month treasury yield curve inversion is showing its strongest recession signal since the recessions of 1980/1981.

The probability of a recession has skyrocketed to levels last seen in the 1980s

— Game of Trades (@GameofTrades_) June 28, 2023

We’re now at an average 62% chance of a recession by May 2024 pic.twitter.com/gDXIzvtP56

The 10-year/3-month inversion is the gold standard of recession indicators and has predicted every recession since the 1950s with only once false alarm in the late 1960s.

The average time from the beginning of a yield curve inversion to the onset of a recession is a little over one year, though it can take significantly longer. Case in point, it took roughly 20 months from the first inversion in early 2006 until the Global Financial Crisis started in late 2007.

The current inversion started last October, roughly eight months ago. As often happens, people started to worry about a recession right after the inversion in October and, after months of worrying ‘in vain,’ have begun to start doubting that a recession is coming at all.

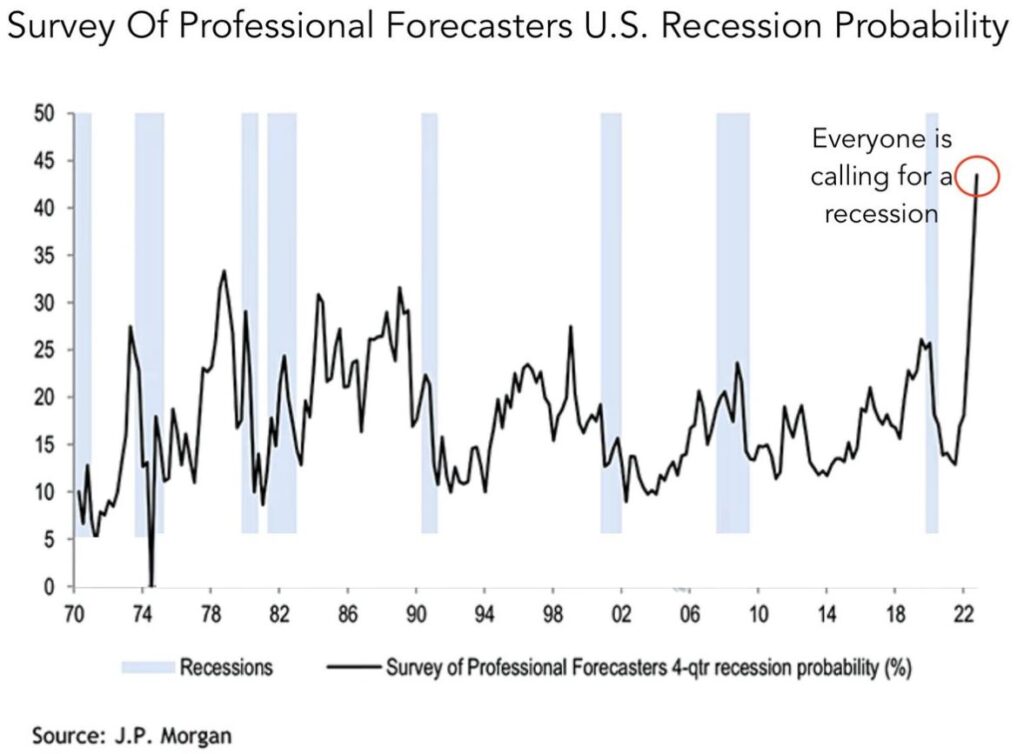

For what it’s worth, implied recession expectations from professional forecasters have peaked and then declined before several past recessions. The following chart, from late last Fall, shows this is clearly an unprecedented period vis-a-vis sentiment and that all historical comparisons should be taken with a grain of salt.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Is that a Ukrain flag icon next to the URL in the address bar?

Has been there since day one of the site:

https://en.wikipedia.org/wiki/International_maritime_signal_flags

Thank god you’re not one of those hypnotized losers with a Ukrainus flag mask.