Taps Coogan – July 18th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

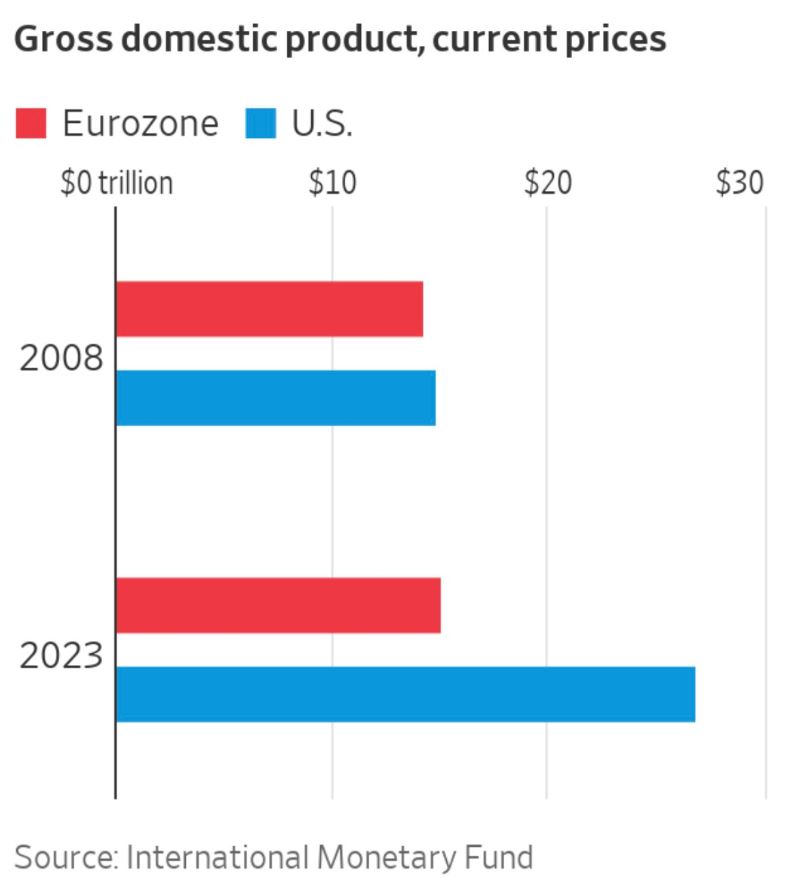

The following cart, via Science is Strategic, highlights how the Eurozone’s ‘lost decade’ just keeps going. While the US and Eurozone economies were roughly the same size when the Global Financial Crisis struck in 2008, the US economy has subsequently grown by about 80% while the Eurozone economy has barely grown at all (as measured in current USD).

Whenever I post an article pointing out the very low rates of growth in the Eurozone compared to the US, someone in inevitably objects to measuring the Eurozone economy in dollars. While I would argue that point as it captures the significant loss in value in the Euro since 2008 relative to the currency in which most global imports are priced, using Euros changes little.

The Eurozone economy has grown by slightly more than 12% since 2008 in inflation adjusted Euros, a compounding rate of less than 1% per year. That compares to 30% in the US, more than double the total growth in the Eurozone.

The Eurozone’s economic problems are manifold: a stagnant working age population, more rapid population aging, higher taxes, an inflexible labor force, a business-hostile regulatory environment, a near total absence of large and fast growing tech companies, and higher energy costs. None of those factors seem poised for improvement. Perhaps most importantly, achieving a dramatically higher rate of economic growth does not appear to be a top priority for EU policy makers or their electorates.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

So what does that graph for the USA look like minus endless government debt spending?