Taps Coogan – August 8th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Back in 2018, we highlighted projections from the CBO that the interest expense on the national debt could exceed 3% by the late 2020s and reach as high as 3.8% by 2035, eclipsing defense spending as the single largest non-entitlement expense of the federal government. At the time we pointed out that even those gloomy predictions were optimistic:

“The forecast assumes that the US avoids a recession for at least the next 17 years and that inflation remains steady between 2% to 2.1% a year.

Needless to say, it is a highly optimistic forecast. The US is already nearing the longest expansion in its history without a recession. Another 17 years without one would be unprecedented…”

Just two years later, we had the Covid lockdowns and recession. Ironically, the initial drop in interest rates led to an improving outlook for the interest expense despite the historic surge in deficit spending.

Of course, that’s not where the story ends. Soon thereafter came inflation and, after that, came higher interest rates, all while deficit spending stayed extremely elevated.

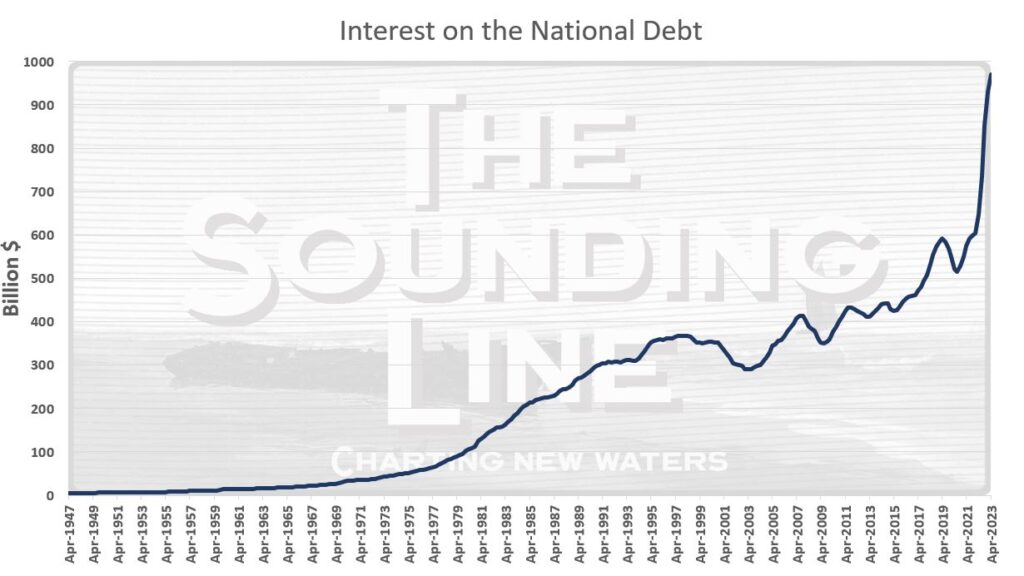

The net result is that the interest on the national debt has reached nearly a trillion dollars, or 3.7% of GDP. To be fair to CBO, their projection of 3.7% of GDP by 2035 excluded intra-government debt (about 30% of interest payments). Adjusted for that, we are surprisingly close where the CBO’s pre-Covid forecasts expected we’d be by now despite all that’s happened: roughly 2.6% of GDP.

The problem going forward is that the CBO is still forecasting that the effective interest rate on the national debt will stay around 2.9% in 2024 (where it is now) and only slowly rise thereafter to 3.2% by 2033. However, the entire treasury market is currently yielding over 4%, making that forecast a mathematically impossibility without a large move lower in rates.

On top of that, the CBO is forecasting a $1.5 trillion deficit for 2023. For those keeping track, the trailing 12 month deficit is already $2.2 trillion and growing.

The punchline is that the CBO’s gloomy outlook for a rising interest burden in coming years is implausibly optimistic.

We’ve likely hit the exponential part of our debt problem. The silver lining is that that means we’re getting closer to finally taking the problem seriously.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.