Taps Coogan – October 9th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

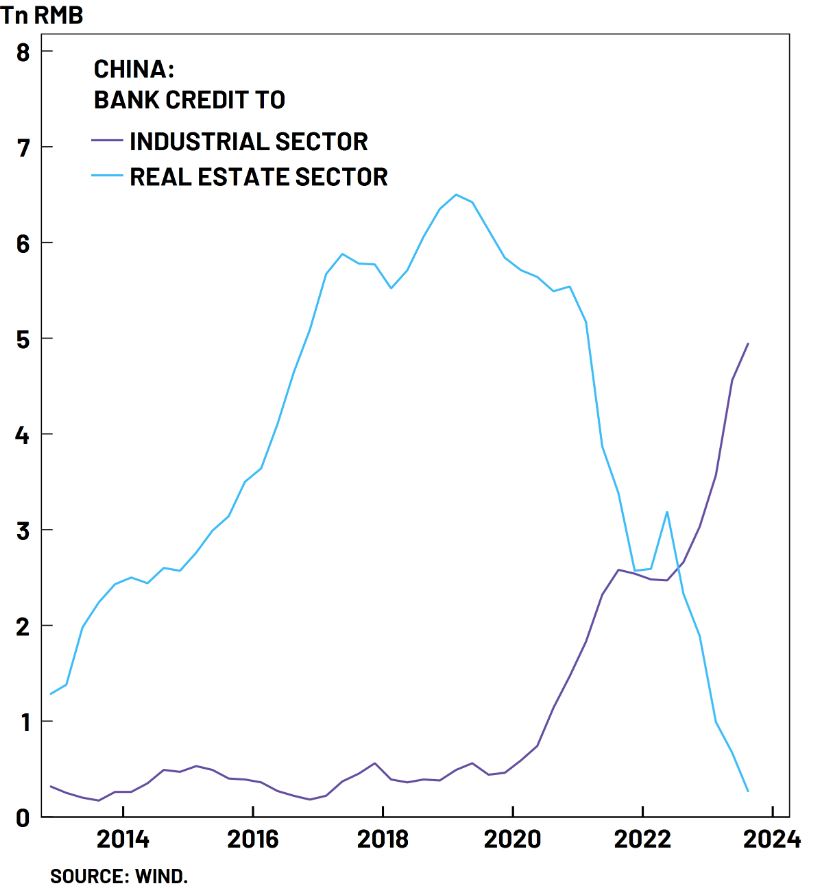

The following chart shows China’s back to the future approach to managing the deflation of its property bubble:

This is probably one of the most important charts right now about the Chinese economy. To offset the collapse in the real estate sector, Beijing has managed to surge credit to the manufacturing sector, which has helped prevent a total collapse of domestic credit growth and demand pic.twitter.com/YPa0LQYYjZ

— Shanghai Macro Strategist (@ShanghaiMacro) October 9, 2023

For at least a decade, China had been trying to pivot away from an export dependent economic model that necessitates low labor costs, high external consumption, and friendly import partners in favor of local consumption. That local consumption was to be driven, in no small part, by its epic real-estate bubble and the associated ‘wealth effect.’ With that plan on the rocks, it looks to be back to the future of China circa 1995.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

More bridges to nowhere? Or, maybe we can finally get that space elevator…

“Beijing has managed to surge credit to the manufacturing sector”

All this just screams INSANITY………income and profits should be the catalyst for demand NOT EVER INCREASING LEVELS OF DEBT.

Agreed