Taps Coogan – December 24th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

The following article is reposted from Visual Capitalist:

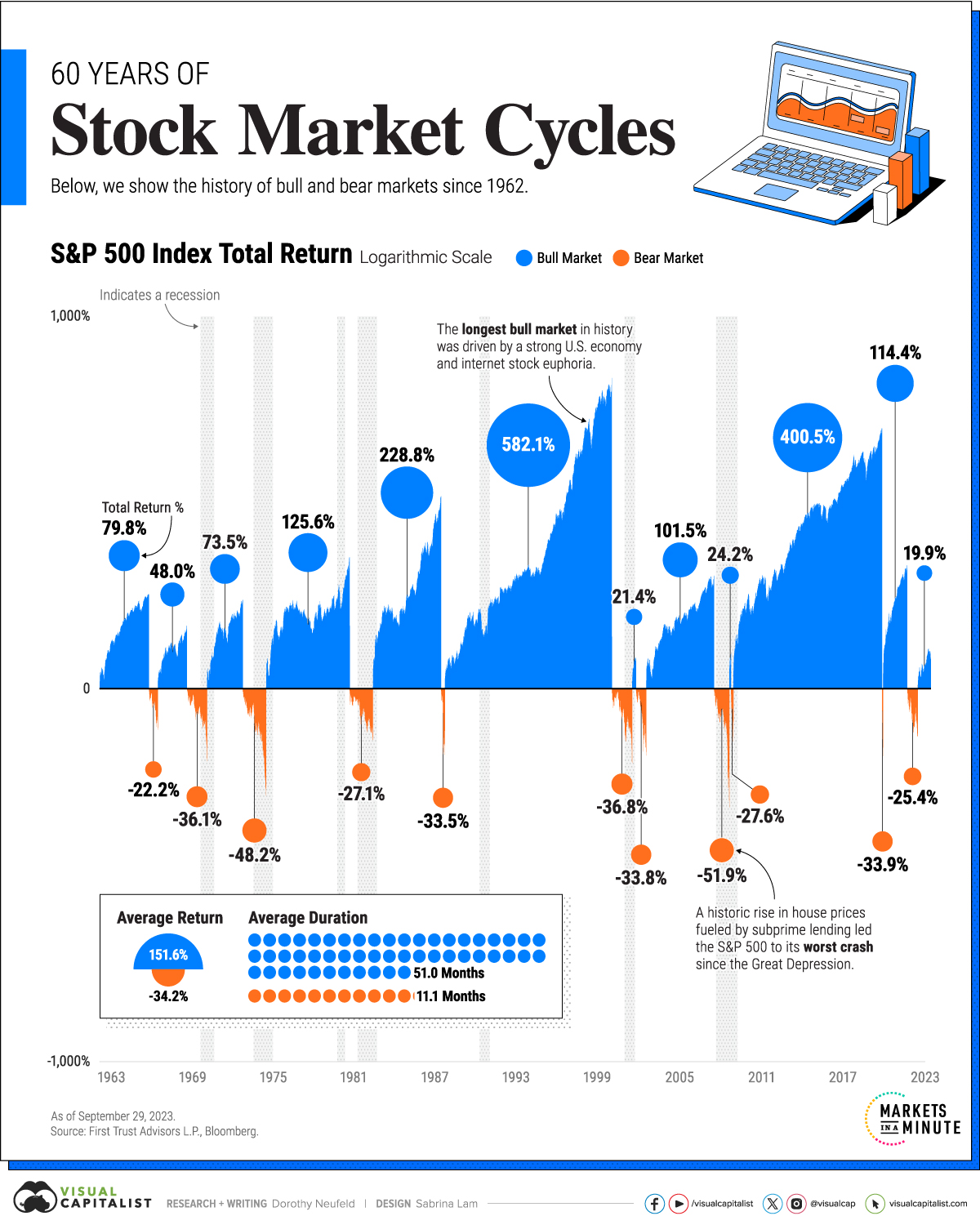

The S&P 500 has climbed over 24% to date against a backdrop of strong economic growth and rising interest rates. Despite these factors, the unemployment rate has remained low at 3.7% as of November, and inflation has moderated.

To give some context on the current stock market cycle, this graphic shows 60 years of bull and bear markets, with data from First Trust.

Bulls and Bears Over History

A bear market takes place when a stock market index declines 20% from its peak.

Once stocks fully recover and exceed this peak, it enters a bull market. This can happen over the course of months or years. But as the table below shows, bear markets have been much shorter than bull markets since 1962:

| Market | Average Return* | Average Duration |

|---|---|---|

| Bull Market | +151.6% | 51.0 Months |

| Bear Market | -34.2% | 11.1 Months |

*As of September 29, 2023.

The longest bear markets over this period were in the early 1970s and 1980s, both lasting roughly 20 months. In both cases, high inflation led the Fed to tighten monetary policy, triggering each recession. In 1974, the S&P plummeted 48.2% from its peak, in one of the sharpest declines since WWII.

On the other hand, the longest bull market took place through the 1990s amid a roaring U.S. economy. Lasting over 12 years, it reached an apex during the Dotcom boom. Over the course of the bull market, the S&P 500 advanced 582.1%.

After the 2008 Global Financial Crisis, the stock market witnessed another expansive bull run, this time lasting 11 years. Ultra-low interest rates and the outperformance of big tech in particular defined the cycle.

In many cases, stock market peaks happen before a recession begins. Consider how in 2007, the S&P 500 hit a high in October before the recession officially began in December. Similarly, the S&P 500 peaked in September 2000, six months before the 2001 recession officially started.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.