Submitted by Taps Coogan on the 11th of August 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

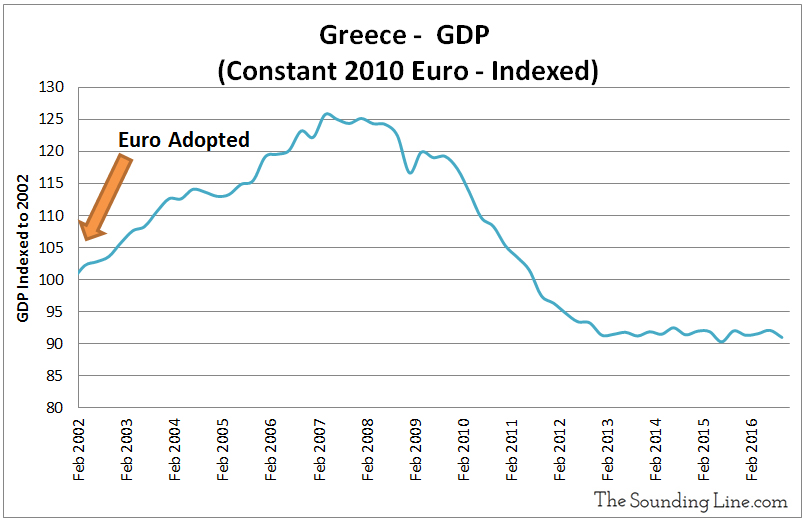

Back in May we pointed out that, adjusted for inflation, the Greek economy had shrunk 9% since adopting the Euro in 2002, wiping out a generation’s worth of economic growth and prosperity:

“The Greek economy is now 9% smaller than when Greece adopted the Euro in 2002. By that fact alone, the Greek economy has experienced some of the worst long term economic ‘growth’ in the entire world.”

While the statement that Greece has experienced some of the worst economic performance in the world may seem like hyperbole, sadly, it is not the case. To illustrate that point further, we analyzed the real gross domestic product (GDP) of every country in the world from 2000 to 2016 in inflation adjusted local currencies based on data from the World Bank. The only countries that were omitted were the handful of countries for which the relevant economic data was not available due to: military conflicts (Somalia, Afghanistan, Syria), not having existed in 2000 (South Sudan), being microstates (Monaco, Andorra, etc..), or in the case of Venezuela and North Korea, an inflation rate that is no longer computable or is unknown. Ultimately, data was available for 181 countries.

The results:

Barring the aforementioned countries, Greece has experienced the largest absolute reduction in real GDP of any country in the world in the 21st century and the third (tied with the Central African Republic) worst economic growth rate of any country in the world.

Immediately following Greece and the Central African Republic comes Italy, which has seen the fourth slowest economic growth in the world in the 21st century, barely 1% growth over the last 16th years. Not far behind, Portugal was the world’s sixth slowest economy at 4% growth over the last 16 years. Remarkably, of the 25 slowest growing countries in the world, seven were Eurozone countries including Germany (somewhat surprisingly), the Netherlands, Finland, and France. Denmark, which is in the EU, but not the Eurozone, was also among the 25 slowest growing countries. I suppose some congratulations are in order to the Eurozone economic leaders for shrinking the economy of Greece less (only on a percentage basis) than 93 year old dictator Robert Mugabe in Zimbabwe and the various factions that run war torn Yemen.

In other words, over the last 17 years, Greek, Italian, and Portuguese economic growth has been worse than in Iraq (despite 15 years of grueling war and insurgency), Iran (despite years of crushing international sanctions), Ukraine (despite its conflict with Russia), Liberia (despite civil war and thousands killed by Ebola), Sudan (despite years of genocide, civil war, and literally being split into two countries), and just about every other country in the world.

It is, of course, more difficult for large developed economies to maintain high rates of growth. Yet even this is hardly an excuse for the negative or near zero growth seen in Greece, Italy, and Portugal. All large developed economies outside the Southern Europe grew quite substantially during the same period. This is especially true given that Japan’s famously slow economy grew a comparatively rapid 13%, Switzerland grew 31%, the UK: 32%, the US: 33%, Canada: 36%, Australia: 59%, and Russia: 71%. China grew an astounding 325%.

While economic growth is not the only important economic metric to judge economies, nor does it guarantee that economic wealth is shared equitably, without economic growth it is simply not possible to have sustained economic betterment for the citizenry of a country.

What is going on in several Eurozone economies cannot be chalked up to a cyclical economic slowdown, or a slow recovery from the 2008 financial crisis, nor is it simply an inevitability of a being a developed economy. The out-performance of virtually every other country on Earth, from larger developed countries to third world countries that have struggled with war, genocide, epidemics, corruption, and revolution disprove this. Greece, Italy, Portugal, and some other Eurozone countries suffer from deep structural problems and some of the most incompetent economic management in the entire world. Perhaps it is time to start holding the self-declared ‘elite’ economic leaders managing the Eurozone accountable to their track record.

As Greece continues to struggle to service its unplayable sovereign debts, it is worth noting that the seven African and Central American countries that have opted to default on their sovereign debts since 2000, have all out grown Greece handedly (with the probable exception of Venezuela). Maybe Greece should take a hint.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

| Country Name | Total GDP Growth Since 2000 (Constant Local Currency – Billions) | % GDP Growth Since 2000 (Constant Local Currency) |

| Yemen, Rep. | -20.16 | -8% |

| Zimbabwe | -0.65 | -4% |

| Greece | -5.41 | -3% |

| Central African Republic | -20.93 | -3% |

| Italy | 13.14 | 1% |

| Micronesia, Fed. Sts. | 0.01 | 3% |

| Portugal | 7.06 | 4% |

| Bahamas, The | 0.66 | 9% |

| Brunei Darussalam | 1.81 | 11% |

| Jamaica | 92.80 | 12% |

| Japan | 61180.99 | 13% |

| Barbados | 0.14 | 14% |

| Denmark | 265.36 | 16% |

| Palau | 0.03 | 17% |

| France | 350.37 | 20% |

| Finland | 31.56 | 20% |

| Germany | 484.54 | 21% |

| Haiti | 2.71 | 21% |

| Netherlands | 114.89 | 21% |

| St. Lucia | 0.53 | 21% |

| Austria | 61.35 | 24% |

| Belgium | 76.75 | 25% |

| Tonga | 0.17 | 27% |

| Cyprus | 3.39 | 27% |

| Spain | 234.93 | 27% |

| Norway | 622.26 | 28% |

| Croatia | 72.34 | 28% |

| Kiribati | 0.04 | 28% |

| Tuvalu | 0.01 | 30% |

| Switzerland | 157.05 | 31% |

| Dominica | 0.29 | 31% |

| United Kingdom | 423.70 | 32% |

| United States | 4152.55 | 33% |

| Antigua and Barbuda | 0.81 | 33% |

| Marshall Islands | 0.04 | 34% |

| Canada | 494.48 | 36% |

| El Salvador | 2.69 | 36% |

| Slovenia | 10.09 | 36% |

| Hungary | 8130.98 | 37% |

| Ukraine | 274.56 | 39% |

| Comoros | 33.03 | 40% |

| Mexico | 4172.03 | 41% |

| Sweden | 1161.90 | 41% |

| Grenada | 0.65 | 41% |

| Liberia | 0.23 | 44% |

| St. Vincent and the Grenadines | 0.55 | 45% |

| Brazil | 552.82 | 46% |

| Argentina | 224.37 | 47% |

| Fiji | 2.66 | 47% |

| Vanuatu | 20.51 | 48% |

| St. Kitts and Nevis | 0.69 | 48% |

| Guinea | 3173.59 | 51% |

| Czech Republic | 1486.43 | 51% |

| New Zealand | 81.87 | 52% |

| Gabon | 1865.89 | 52% |

| Samoa | 0.63 | 52% |

| Madagascar | 245.47 | 53% |

| Macedonia, FYR | 153.58 | 55% |

| South Africa | 1116.95 | 57% |

| Burundi | 621.10 | 57% |

| Guinea-Bissau | 163.02 | 57% |

| Iceland | 727.85 | 58% |

| Australia | 613.84 | 59% |

| Luxembourg | 18.07 | 59% |

| Suriname | 3.32 | 59% |

| Montenegro | 0.64 | 60% |

| Serbia | 1220.46 | 61% |

| Uruguay | 258.85 | 61% |

| Iran, Islamic Rep. | 783097.55 | 62% |

| Malta | 3.38 | 63% |

| Guyana | 173.95 | 65% |

| Bosnia and Herzegovina | 10.85 | 65% |

| Togo | 604.78 | 66% |

| Gambia, The | 9.80 | 66% |

| Cote d’Ivoire | 6929.64 | 66% |

| Seychelles | 3.46 | 66% |

| Estonia | 7.08 | 66% |

| Tunisia | 27.91 | 67% |

| Belize | 1.11 | 67% |

| Swaziland | 16.34 | 68% |

| Oman | 11.26 | 69% |

| Israel | 498.07 | 70% |

| Russian Federation | 25397.33 | 71% |

| Bulgaria | 35.09 | 72% |

| Guatemala | 104.44 | 73% |

| Trinidad and Tobago | 37.90 | 74% |

| Solomon Islands | 2.08 | 74% |

| Poland | 738.37 | 75% |

| Hong Kong SAR, China | 1055.98 | 76% |

| Latvia | 9.40 | 76% |

| Algeria | 2629.58 | 78% |

| Romania | 177.02 | 81% |

| Nepal | 342.88 | 81% |

| Nicaragua | 80.22 | 82% |

| Saudi Arabia | 1167.47 | 82% |

| Korea, Rep. | 687421.20 | 84% |

| Ecuador | 31.60 | 84% |

| Honduras | 89.93 | 84% |

| Paraguay | 13903.87 | 85% |

| West Bank and Gaza | 3.70 | 85% |

| Lesotho | 11.49 | 86% |

| Chile | 67538.71 | 86% |

| Cameroon | 5717.41 | 86% |

| Thailand | 4553.73 | 87% |

| Mauritius | 155.22 | 88% |

| Lithuania | 16.10 | 88% |

| Congo, Rep. | 772.77 | 88% |

| Slovak Republic | 36.96 | 88% |

| Colombia | 256914.00 | 90% |

| Kuwait | 19.00 | 90% |

| Djibouti | 60.67 | 90% |

| Cuba | 25.93 | 91% |

| Benin | 1951.11 | 91% |

| United Arab Emirates | 663.11 | 91% |

| Egypt, Arab Rep. | 914.39 | 91% |

| Lebanon | 30327.21 | 92% |

| Costa Rica | 13038.10 | 93% |

| Ireland | 116.04 | 93% |

| Botswana | 42.92 | 94% |

| Pakistan | 5712.83 | 94% |

| Albania | 385.05 | 94% |

| Senegal | 3090.76 | 95% |

| Cabo Verde | 71.61 | 96% |

| Kyrgyz Republic | 20.58 | 97% |

| Bolivia | 22.02 | 98% |

| Morocco | 453.47 | 99% |

| Malawi | 652.42 | 99% |

| Mauritania | 448.06 | 106% |

| Moldova | 17.28 | 108% |

| Iraq | 105654.78 | 109% |

| Namibia | 57.21 | 110% |

| Belarus | 1.01 | 111% |

| Kenya | 2265.82 | 111% |

| Malaysia | 584.36 | 112% |

| Turkey | 839.67 | 115% |

| Jordan | 6.22 | 115% |

| Sao Tome and Principe | 2102.32 | 116% |

| Kosovo | 2.70 | 116% |

| Niger | 1769.17 | 119% |

| Singapore | 218.78 | 119% |

| Mali | 2542.25 | 120% |

| Dominican Republic | 1224.97 | 120% |

| Timor-Leste | 0.67 | 120% |

| Sudan | 17.62 | 124% |

| Peru | 278.89 | 126% |

| Philippines | 4545.69 | 127% |

| Indonesia | 5311308.16 | 129% |

| Sri Lanka | 5137.10 | 133% |

| Congo, Dem. Rep. | 6331.19 | 135% |

| Georgia | 6.42 | 139% |

| Sierra Leone | 5294.59 | 142% |

| Burkina Faso | 2738.32 | 145% |

| Bangladesh | 5306.24 | 150% |

| Ghana | 22.33 | 162% |

| Armenia | 1333.63 | 166% |

| Vietnam | 1916359.00 | 168% |

| Panama | 23.53 | 169% |

| Zambia | 81.72 | 172% |

| Uganda | 35628.56 | 177% |

| Kazakhstan | 8407.96 | 181% |

| Tanzania | 30517.23 | 183% |

| Nigeria | 45037.26 | 190% |

| Angola | 1126.92 | 201% |

| India | 82199.84 | 207% |

| Mongolia | 10794.71 | 207% |

| Lao PDR | 73773.88 | 210% |

| Uzbekistan | 2334.35 | 212% |

| Bhutan | 43.16 | 219% |

| Mozambique | 322.53 | 221% |

| Chad | 3571.58 | 222% |

| Cambodia | 31886.78 | 226% |

| Macao SAR, China | 246.40 | 227% |

| Tajikistan | 4.09 | 229% |

| Rwanda | 4424.00 | 235% |

| Turkmenistan | 37.32 | 268% |

| Ethiopia | 607.82 | 300% |

| China | 49207.06 | 325% |

| Azerbaijan | 15.81 | 335% |

| Equatorial Guinea | 4592.95 | 336% |

| Myanmar | 47482.39 | 370% |

| Qatar | 628.08 | 374% |

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The EU it seems, never had the interests of these countries at heart.

The Eurozone perhaps. It’s hard to believe that they didn’t understand the implications of tying together such different economies with one currency given the troubles that they had already had with currency pegs

A column with inflation since 2000 would be intelectually honest, since what matters in terms if wealth creation is real growth and not nominal growth.

The entire article is about real growth and all the figures refer to real growth.

“To illustrate that point further, we analyzed the real gross domestic product (GDP) of every country in the world from 2000 to 2016 in inflation adjusted local currencies based on data from the World Bank”

apologies then. I was a victim of fast reading it seems. Still, debt fuelled growth as in PT or GR does not seem to be a good idea unless you never intend to pay it back…

It doesn’t make sense to blame the Euro for the economic crisis in Greece, when in the first 6 years of adoption of the Euro by Greece, the economy grew by roughly 25%. It only stopped growing in the 2008 economic crisis! So the adoption of the euro was clearly not the determining factor. The response to the 2008 crisis was.

I don’t blame just the Euro, I blame the Eurozone’s economic policies, just one of which is the Euro. As I discuss partially in this article (https://thesoundingline.com/taps-coogan-italy-has-99-problems-austerity-isnt-one/), Italy and Greece have some of the highest taxes in the world. Italian tax collection relative to GDP is the fifth highest in the world. They have the second highest payroll taxes. Italy and Greece rank near the bottom of the developed world for economic freedom, below countries like Kyrgyzstan. Despite being some of the most elderly countries in the world, they have nearly the lowest retirement age and shortest average careers. They… Read more »