Taps Coogan – February 27th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The consensus narrative on markets goes something like this:

If the economy slows or inflation expectations drop, the Fed can do more QE to boost growth and inflation. If the economy heats up and yields rise too quickly, the Fed can do more QE at the long end of the treasury curve to keep yields from rising. If nothing happens, the Fed can keep its ~$1.5 trillion-a-year QE program on auto-pilot and worry about tapering at some hypothetical point in the future.

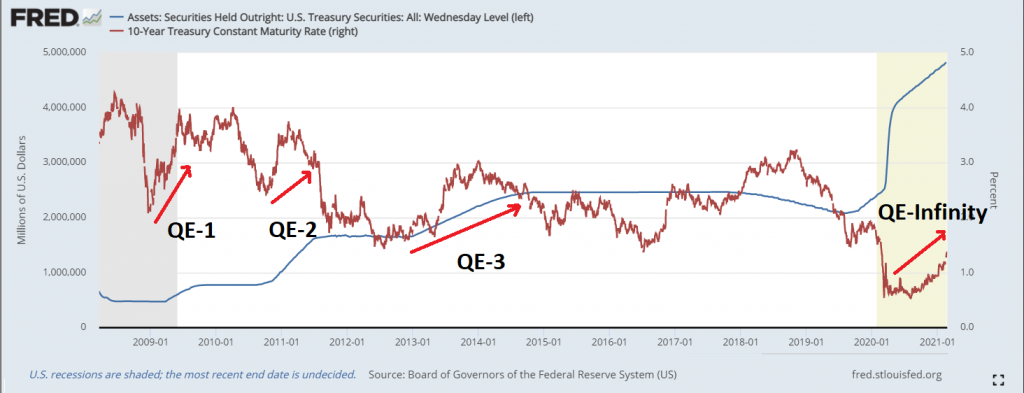

In other words, the Fed can keep throwing more QE at every problem that comes along, just like they have been doing for the past 12 years, and keeping doing QE in the meantime.

Here is the rub: more QE cannot simultaneously be the solution to low inflation and the novocaine for rising inflation.

If the Fed increases QE at the long end of the treasury curve in response to rising inflation expectations and yields, both will rise faster. Every QE program that the Fed has done has ended with rates higher than when they started. The overarching trend of declining long term rates is the result of the periods between QE programs.

The End of an Era

It has long been clear that whenever the market started to care about inflation expectations and rising treasury yields, the hidden costs of the Fed’s decade long experiment in moral hazard would impose themselves.

We have reached that point. Seemingly all of a sudden, the financial media is awash with stories about the rise in long term treasury yields pressuring equity prices. The assets that have benefitted from years of falling yields are correcting. This is already the second worst bear market for treasury bonds in 40 years and rates are still near historic lows. Take notice, the paradigm has shifted.

We’ve had taper tantrums before, but never one without any taper from the Fed.

The current QE program isn’t anywhere near big enough to keep the parade of multi-trillion dollar pork-filled ‘stimulus’ bills from pulling long yields higher and throwing the ‘search for yield’ in reverse. When the Treasury draws down their excessive general account balance, that problem will get worse much faster.

Increasing QE to keep pace with these ‘stimulus’ bills won’t actually help, nor will more ‘stimulus’ bills. It will just increase inflation expectations further.

The consensus view may be correct in the sense that the Fed will try to throw more QE at whatever comes next, but the Fed’s days of ‘helping’ markets are over.

Nothing moves in a straight line. Reflation expectations have probably gotten ahead of themselves, but perhaps that’s the point. The Goldilocks zone for markets is an economic outlook worse than today’s.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.