Taps Coogan – October 23rd, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

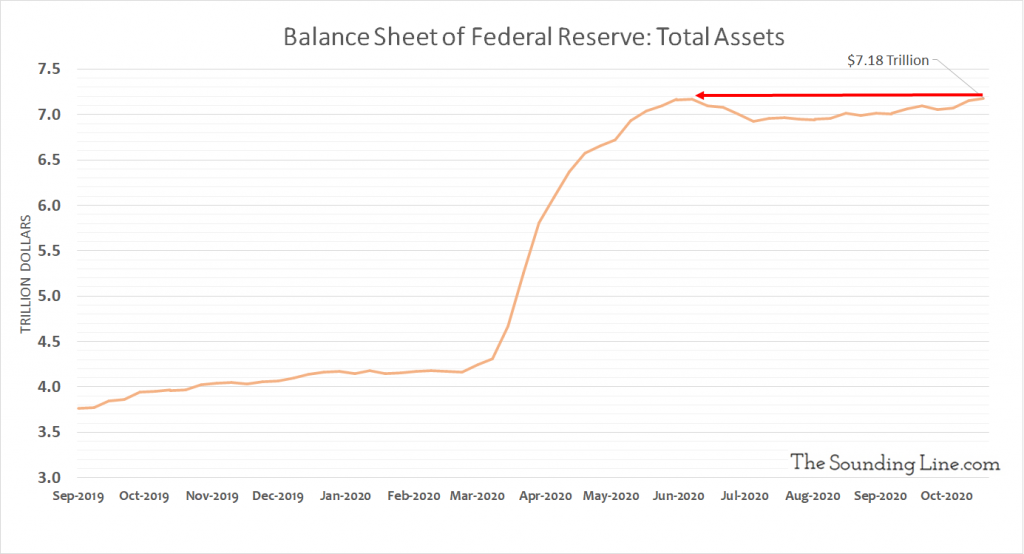

The Federal Reserve’s balance sheet hit a high of $7.16 trillion during the week of June 10th, 2020 as the Fed gorged itself on financial assets amid the Covid economic fallout.

Much of the buying that pushed the Fed’s balance sheet up to over $7 trillion in June was short term assets aimed at bailing out various funding markets: repurchase agreements, central bank liquidity swaps, commercial paper, etc… The Fed bought over $1 trillion of these assets.

Starting in late June, the Fed started to bleed those short term assets off of its balance sheet while continuing to grow its longer term holdings of Treasury debt and Mortgage-Backed Securities (MBS). The net results of the re-balancing was a slight contraction in the Fed’s balance sheet which dipped slightly below $7 trillion in July and August. The balance sheet resumed growth in September and has now hit a new all time high on the back of record treasury and MBS holdings.

With the Fed’s repo holdings down to zero and its liquidity swap position down to just $7 billion, its treasury and MBS positions are likely going to be the main drivers of balance sheet growth from here on out.

The Fed has committed to roughly $120 billion of Treasury and MBS purchases a month for the foreseeable future, double the pace of QE3. That means that he Fed is now on a $1.4 trillion-a-year autopilot QE program. For those that remember QE3, get ready for an even wilder ride.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“Deficits don’t matter.”

-Dick Cheney

And who wouldn’t trust Dick Cheney?