Submitted by Taps Coogan on the 16th of January 2017 to The Sounding Line

Enjoy The Sounding Line? Click here to subscribe for free.

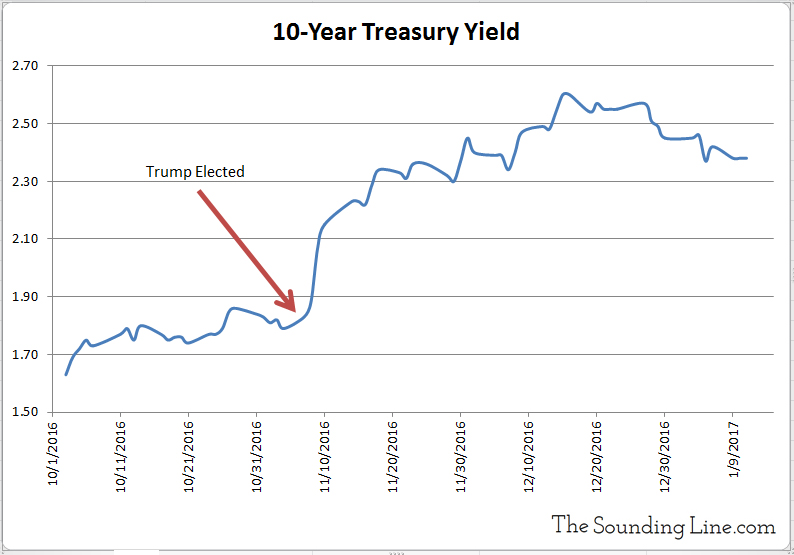

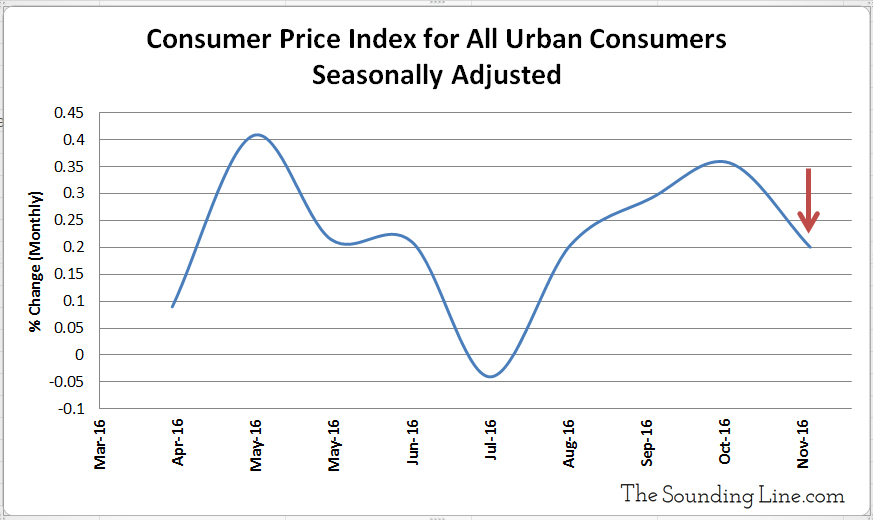

An enormous amount has been made of the increase in interest rates and inflation since the November 8th election of Donald Trump as President of the US (here, here, here, here, here, etc…). There is no doubt that benchmark 10-Year US Treasury yields have surged strongly since Trump’s election. However, it is important to note that increased inflation expectations are still just that: expectations. The Fed’s consumer price index data is calculated monthly and the most recent month of November (election month) showed a decrease in monthly CPI growth compared to October.

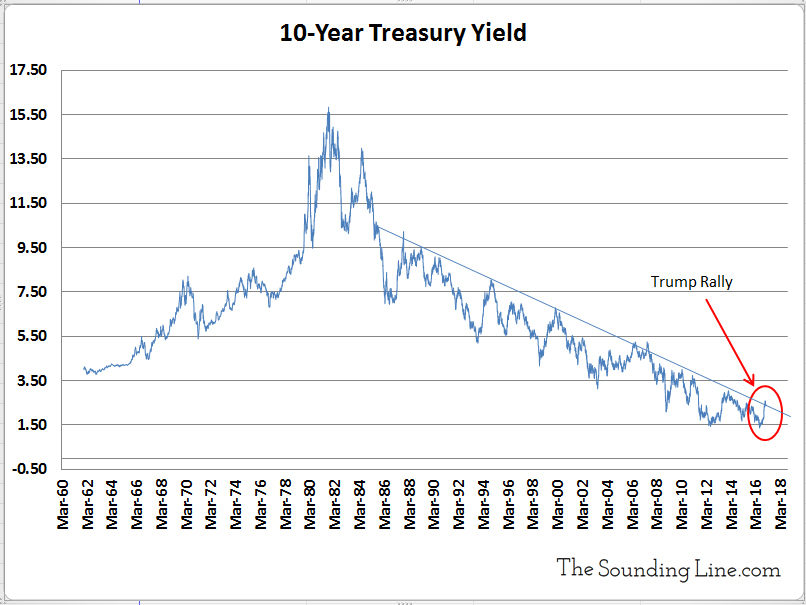

The current long term trend of declining interest rates and inflation is rooted all the way back in 1981 when the 10-Year yields reached a monthly high over 15%. When one takes a long term perspective on interest rates (see the chart below), it becomes clear that the post-election surge in 10-Year yields has not fundamentally altered the downward trend yet but it has brought rates to a critical level. The possibility now exists for a breakthrough that could end the long term declining trend.

As a number of analysts have noted, significant attention should be focused on whether interest rates break to higher levels (see Bond King Bill Gross here). That could mark the transition to a long term bond bear market or a retesting of the lows, a move that would see flat to declining rates through 2017, before the 36 year bond bull market truly, finally, dies.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.