Taps Coogan – January 20th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

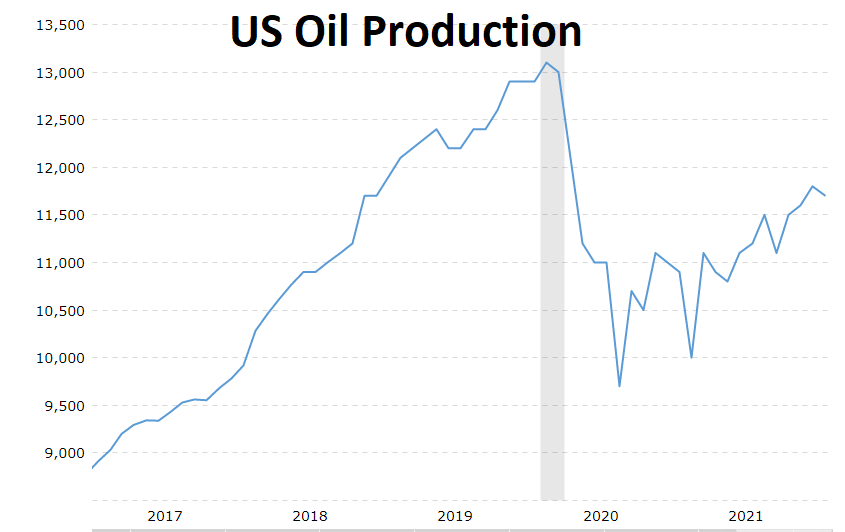

Just days before the whole Covid saga exploded onto the scene in February, 2020, we finished off a long series of articles on shale oil and gas production in the US, coming to the conclusion that 2019 shale oil production levels were unsustainable and that, in the long run, higher prices would likely be required to bring more production online. Then Covid happened… putting the whole argument on ice as economic activity grinded to a halt.

As things have gotten back to some perverse new ‘normal,’ it’s become increasingly clear that US oil production is struggling to get back to 2019 production levels, despite the highest prices since 2015.

Within that context, Art Berman – geologist and energy analyst – spoke with Wealthion to discuss his oil and gas outlook. That outlook is basically that growth oil and gas production is topping out, meaning that prices will likely stay higher for the foreseeable future, albeit perhaps not quite as high as current prices.

Some excerpts from Art Berman:

“I think we are currently at the upper limits of where prices for things like oil and natural gas and all of the products that come from them are going to be… but what’s a lower price? Let’s say we are at $80-$85 for oil right now… I think we’ll be at $70 to $75… That is… perhaps the new normal… We’ve gotten used to relatively low energy prices for the last four or five years and that secular period of oversupply is over. That period of secular over supply only happened because of the tight oil that got developed in the United States. Super high prices in 2011, 2012, 2013, and part of 2014 allowed all sorts of crazy things to happen and one of them was drilling these shale wells… The net result was the world’s oil supply still hasn’t grown since 2005 except for this wedge of mostly US tight oil or shale and that grew four or five million barrels a day, which is a huge percent of global production, which caused oil prices to collapse in late 2014, and we had too much oil for 2016, 2017, most of 2018… That’s over. We’ve worked through the flush period of another source of oil. We haven’t used it all up yet but the growth is pretty much gone. So we are back to where we were 15 years ago where if demand keeps going up, where is the supply going to come from? The answer is we just don’t know…”

There is much more to the wide ranging interview, so enjoy it above.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.