Taps Coogan – June 2nd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

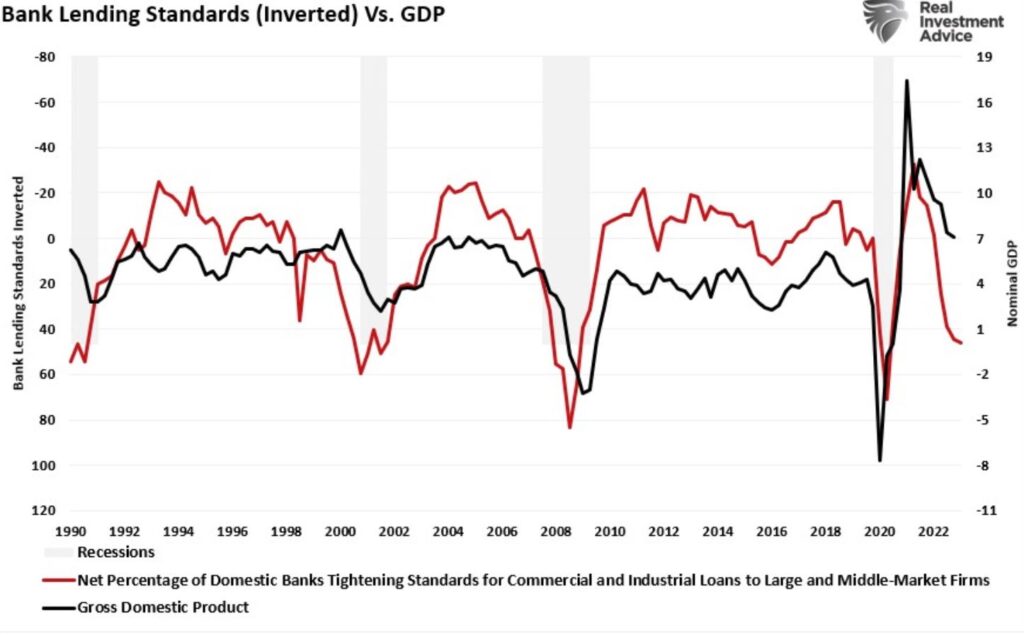

While markets have clearly given up worrying about a recession, the laundry list of indicators warning of one keeps growing. The latest example, via Real Investment Advice’s Lance Roberts, highlights the relationship between tightening bank lending standards and GDP.

Nominal GDP, shown above, is still fairly far away from ‘zero’ but real GDP (inflation adjusted) only has 1%-2% of room to give before we’re in at least a mild recession.

We suspect that the surge in new Treasury debt that is going to hit markets in the second half of this year, soaking up ~$500 billion in liquidity, will make the recessionary outlook more clear to markets.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.