Submitted by Taps Coogan on the 20th of January 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

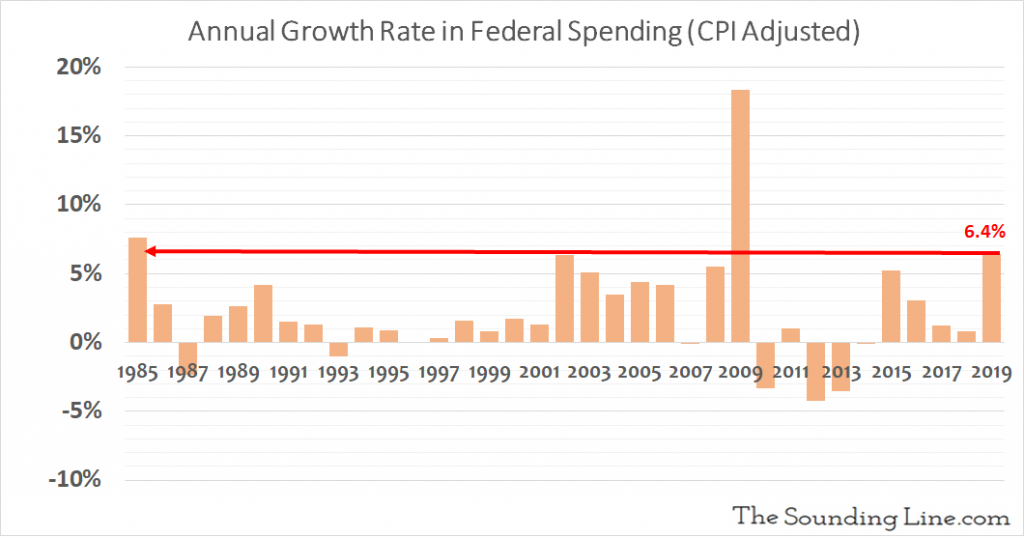

The US federal government spent roughly $4.45 trillion dollars in fiscal year 2019, an 8% increase compared to the prior year. Adjusted for inflation (headline CPI), spending increased by 6.4%. That 6.4% increase represented the fastest increase in real federal spending since the Financial Crisis, when spending surged via TARP and other economic recovery programs. Barring the Financial Crisis (2009), 2019 saw the fastest increase in inflation adjusted federal spending since 1985, the height of Ronald Reagan’s Cold War military buildup.

Regardless of how one feels about the recent Tax Cuts and Jobs Act of 2017, the explosion in the federal budget deficit has as much to do with runaway spending as it has to do with tax revenues. While the rate of growth in tax revenues has moderated due to the tax changes, overall tax revenues have continued to set record highs every year, growing by 3% in 2019 (roughly 1.5% adjusted for inflation).

Given the accomodative stance of monetary policy (the Fed’s balance sheet has grown at a 30% annualized rate for the last several months), the recent tax and regulatory cuts, the rapid increase in federal spending, the recent acceleration in the broad money supply, and the detente in the US-China trade deal, it is quite peculiar that the US economy is only growing at 2%. Either an economic ‘sugar high’ is around the corner or the structural problems in the US economy have become insurmountable.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.