Taps Coogan – February 25th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

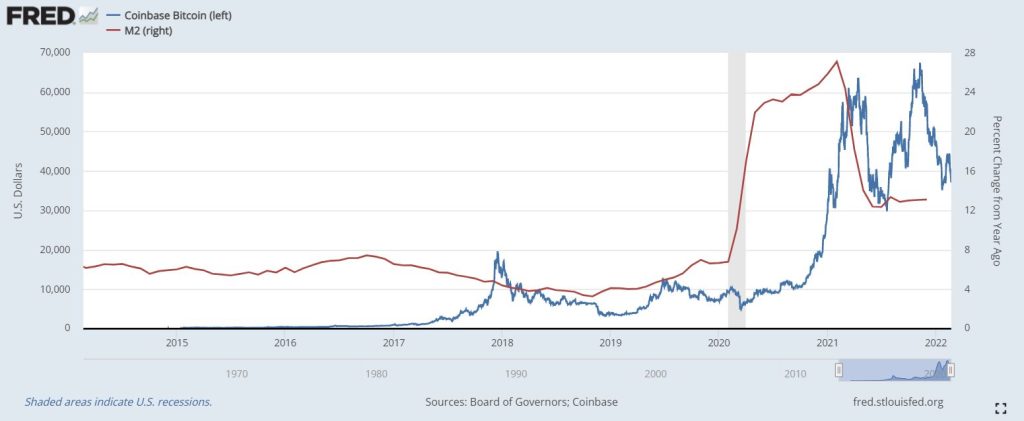

If it wasn’t already clear, the last few months and especially the last few days have highlighted that there is effectively no correlation between Gold and Bitcoin prices. The following chart, from the Daily Shot via Win Smart, captures the divergence from last week, before Russia’s Ukraine invasion started.

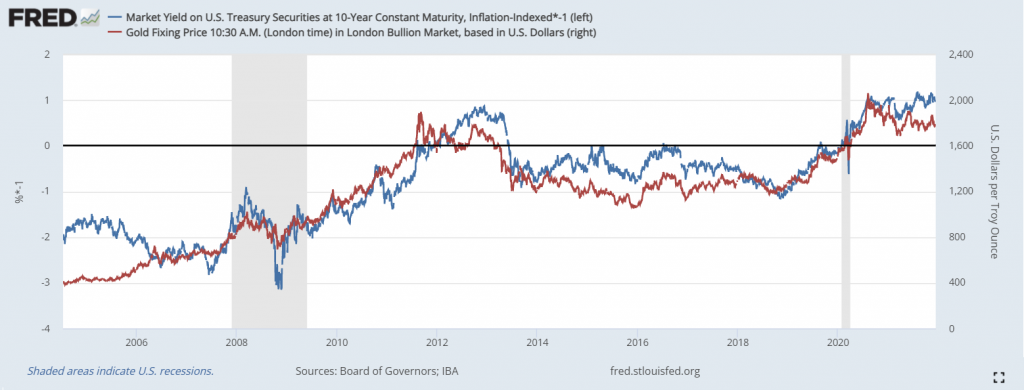

If Bitcoin were digital gold, it would being doing what gold has done for the last 17 years, namely, it would provide a hedge against declining real ‘risk free’ long term rates.

However, Gold and Bitcoin are clearly reading from different scripts. To the extent that Bitcoin measures anything, it’s probably just excess liquidity.

While the difference between real ‘risk free’ long term rates and excess liquidity may sound academic, it’s not, particularly as the former remains high and the later starts to constrict.

Then there is the geopolitical risk. Since Russia started staging its Ukraine invasion in early December, gold has rallied about 5% while Bitcoin has fallen about 12%.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.