Submitted by Taps Coogan on the 5th of December 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

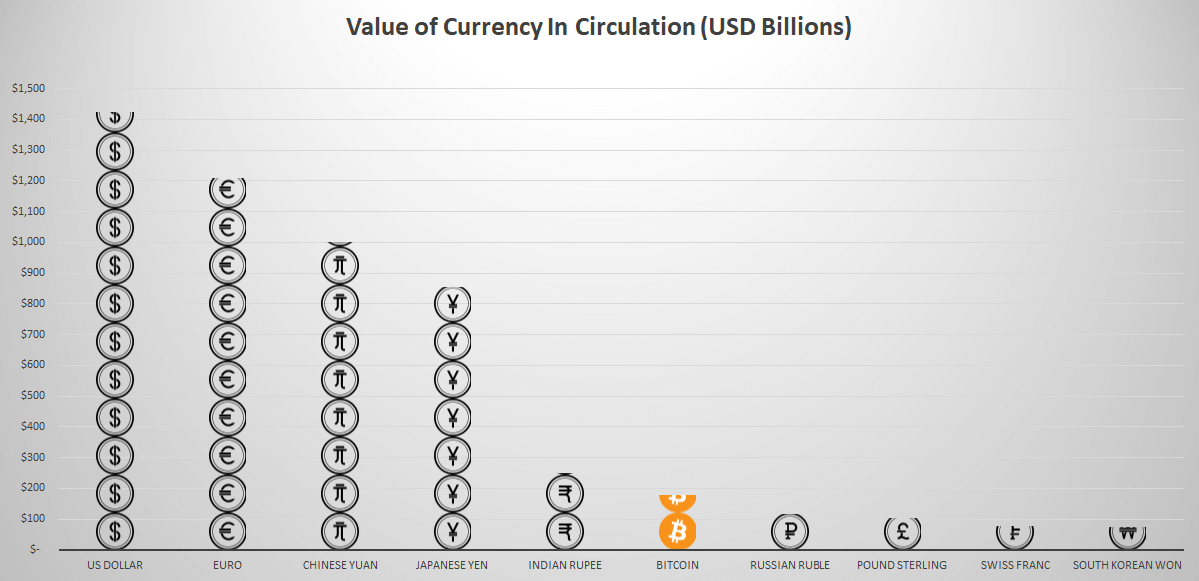

As Small Business Prices is reporting, the value of all Bitcoin in circulation has now exceeded the value of all UK Pound Sterling banknotes and coins in circulation, effectively becoming the 6th most valuable currency by this metric:

-

- “The current value of all Bitcoins ($180 billion) is greater than the value of all banknotes and coin of most other countries/currencies including the UK ($103 billion), Canada ($59 billion) or Australia ($55 billion).

- Currently 54% of the world’s population live in countries with currencies in circulation worth less than the value of Bitcoin.

- If the price of Bitcoin rises to $15,000 it will overtake the value of all Indian Rupee banknotes and coins in circulation to become the 5th most valuable currency. Which given it’s recent growth rate it could do within the next month.

- However, Bitcoin’s price needs to increase to a staggering $72,300 to overtake the Euro and become the 2nd most value currency.

- And to beat the US Dollar, in terms of circulation value, it would need to increase in price to at least $85,160.

- Bitcoin is the only Cryptocurrency in the top 10 currencies worldwide, but both Ethereum and Bitcoin Cash are in the top 20.

- At a price of $458.82 the total market cap of Ethereum stands at $44 billion, making it the 17th most valuable currency, worth more than the value of all banknotes and coins in circulation of countries such as Turkey ($36 billion) and Singapore ($27 billion).

- Bitcoin Cash’s current price of $1,425.21 gives it a market cap of $24 billion, making it the 20th most valuable currency, worth more than all Swedish Krona ($9 billion) or South African rand ($6 billion) banknotes and coins.

- Ripple just misses the Top 20 with a value of $10 billion, but still puts it ahead of Krona or Rand.”

As these statistics highlight, the rise of Bitcoin has been meteoric. However, it is an incomplete story to say that Bitcoin is now the 6th largest currency. While Bitcoin may have eclipsed the Pound Sterling in terms of currency in circulation, currency in circulation is only one subset of the total usage of the Pound Sterling. The same is true for all national currencies. While the value of Pound Sterling in circulation may be $103 billion, when one adds demand deposits, deposits in checking accounts, savings accounts, and certificates of deposits (M2 money), the value of the Pound Sterling is over $2 trillion, 11 times that of Bitcoin. If one then adds money market accounts, repo agreements, and other large less liquid financial instruments, the value of all Pound Sterling is over $3.6 trillion.

Much of the desirability, and thus value, of Bitcoin is rooted in its perceived anonymity and decentralization. As we have been reporting here at The Sounding Line, these foundations have been coming under attack in new and very serious ways. First, as we discussed here, the IRS has won a court order to have Coinbase turn over user data on anyone who traded more $20,000 in Bitcoin. Now, as Martin Armstrong is reporting, and as we highlighted in the Top News Stories column on the left hand side of The Sounding Line:

“The Judiciary Committee of the United States Senate is currently working on Bill S.1241 that aims to criminalize deliberate concealment of property or the control of a financial account. The bill was submitted in June, and the law would change the definition of “financial account” and “financial institution,” and thus also cover digital currencies and digital exchanges.”

“The bill will change the definition of “financial institution” in Section 53412 (a) of Title 31 , United States Code. The text will read:

“An exhibitor, a redeemer or a cashier of prepaid access devices, digital currency or a digital exchanger or a digital currency.”

The regulation will remove the anonymity of Bitcoin and other cryptocurrencies defeating this idea that there is an alternative-financial-universe separate from government.”

The idea that the established financial powers are going to tolerate the sort of anonymous financial system that Bitcoin reputes to offer, after spending decades doggedly snuffing out banking secrecy around the world, is a joke. Because the financial establishment has waited this long to begin to move on Bitcoin, it has allowed an enormous number of casual investors and trend followers to pour money into Bitcoin. When it becomes clear that: trading in and out of Bitcoin is not actually anonymous, that the IRS wants the taxes its owed, and that Bitcoin miners will be pursued by the courts if they don’t turn over transaction data, the prevailing casual interest in Bitcoin will be greatly damaged. That may not be the end of Bitcoin, but it will likely be the end of its meteoric rise.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

None of this is news. Pay the expected taxes and continue to enjoy the opportunity that emerging markets provide.

Considering that only 802 people have paid taxes on Bitcoin according to the IRS, it is news to 99+% of everyone who trades Bitcoin.

https://cointelegraph.com/news/only-802-people-paid-taxes-on-bitcoin-profits-irs-says