Taps Coogan – March 30th, 20201

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The popular narrative is that Bitcoin is a hedge on central bank monetization and fiat currency debasement. While that may be the case, it has always been hard to square that narrative with the Bitcoin bull market in 2017, which corresponded to a period when the Fed was holding its balance sheet flat and talking about the first meaningful taper since the Global Financial Crisis.

The opposing narrative is that Bitcoin is just the bleeding edge measure of speculative froth in financial markets.

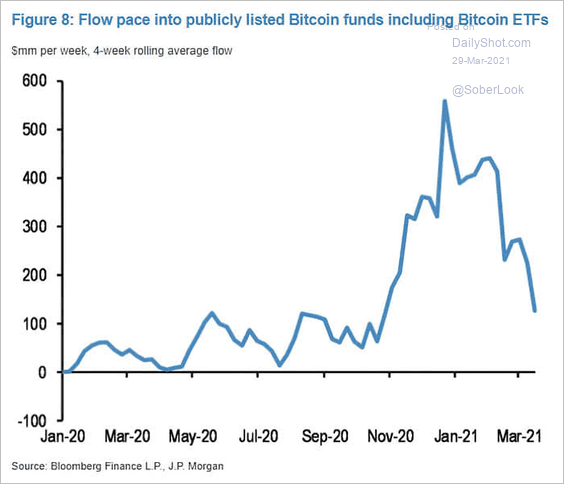

If the latter is the case, the following chart, from The Daily Shot, reinforces the gravity of the problem facing the momentum driven parts of the market, especially now that the last round of consumer directed stimulus checks for the foreseeable future is already largely out the door.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.