Taps Coogan – February 25th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

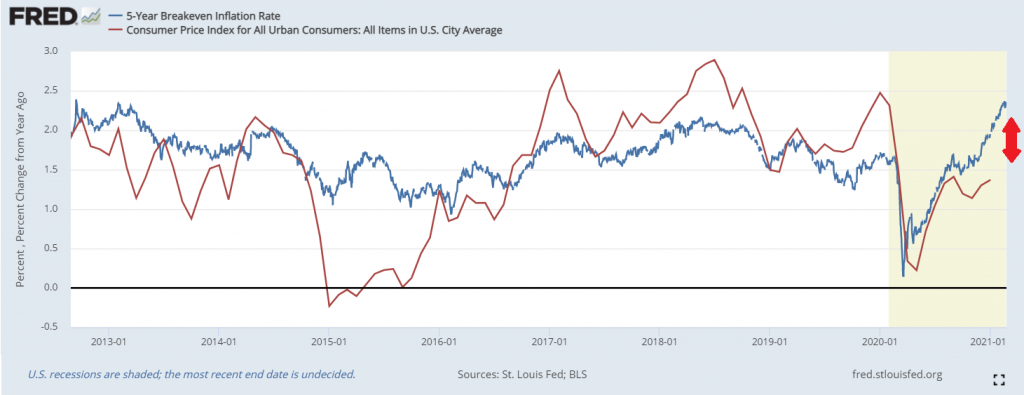

TIPS inflation breakevens have surged over the past few months, as we have discussed a few times. The 5-Year, 10-Year, and 30-Year breakevens are all pointing to inflation averaging above the Fed’s suspended 2% inflation target through their respective durations.

The following chart shows how well the 5-Year breakeven inflation rate compares to PCE inflation (Technically breakevens price off of CPI, but the Fed uses PCE so that’s what I use). Because the 5-Year implied inflation rate is a ‘real-time’ rate, it is an interesting leading indictor for CPI and PCE inflation, which lag by a month.

Breakevens aren’t perfect predictors of inflation. They missed the oil crash inspired drop in inflation in 2015 and have modestly understated inflation since then.

More generally, if a factor that predicts something over a five or ten year time period is changing meaningfully day to day or week to week, take it with a big grain of salt. Like betting markets, breakevens aren’t really predictive. Instead, they reflect the prevailing sentiment of the day. As can be seen above, changes in breakevens line up better with real time changes in inflation than what happens over the subsequent five years.

Keeping all that in mind, breakevens are saying that PCE is going to overshoot the Fed’s former inflation target very soon, perhaps within a few months.

While the Fed might not care about inflation overshoots anymore, until they implement yield curve control, the long end of the treasury curve, and by extension the rest of the market, certainly do.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.