Submitted by Taps Coogan on the 13th of April 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

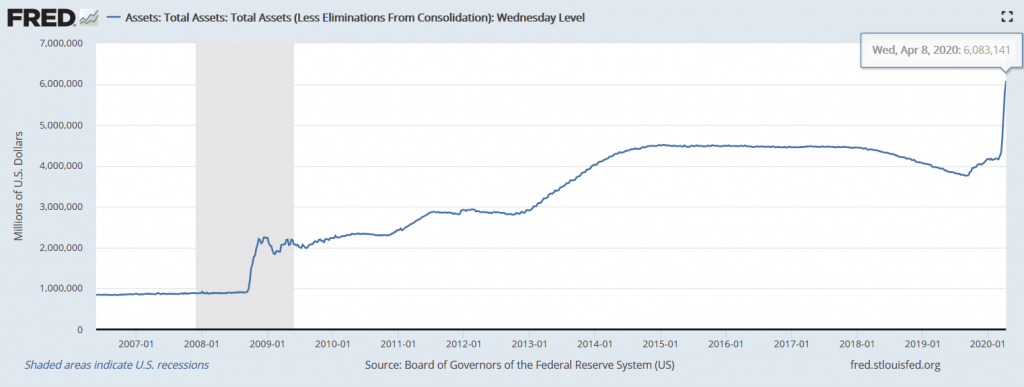

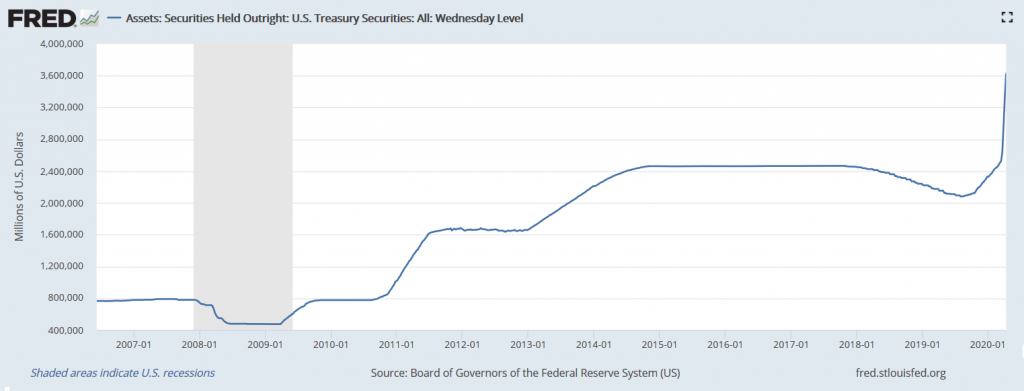

Last week, the Federal Reserve added $271 billion to its balance sheet as it continues to amass a bewildering diversity of financial assets and as it continues to bailout every financial market in sight. That pushed to Fed’s balance sheet over $6 trillion for the first time, a 62% increase compared to its balance sheet from September.

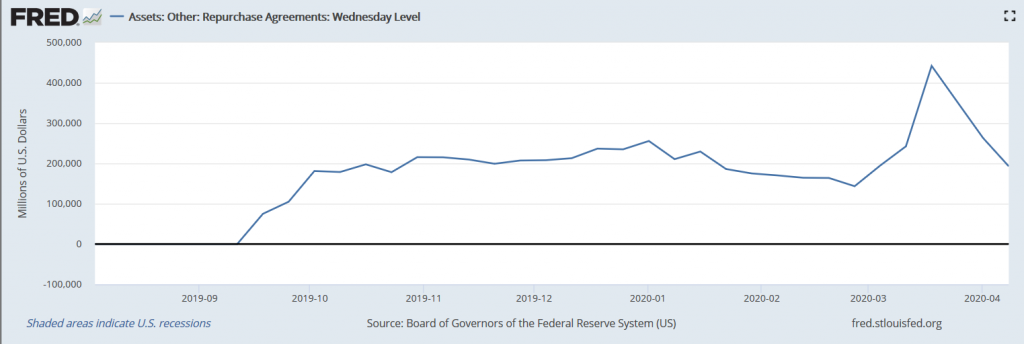

While $271 billion in one week is a faster pace of ‘money printing’ than during all but one week of the financial crisis, it is actually a considerable slowdown from the two weeks prior when the Fed ‘printed’ $586 and $557 respectively. The primary driver of the ‘slowdown’ in the Fed’s balance sheet growth last week was a decline in repo holdings. As the Fed has scaled up its full-bore QE, banks’ requirement to borrow reserves in the repo markets appears to finally be subsiding. Nothing like an unlimited bailout to shore up banks’ balance sheets.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.