Taps Coogan – January 21st, 2024

Enjoy The Sounding Line? Click here to subscribe for free.

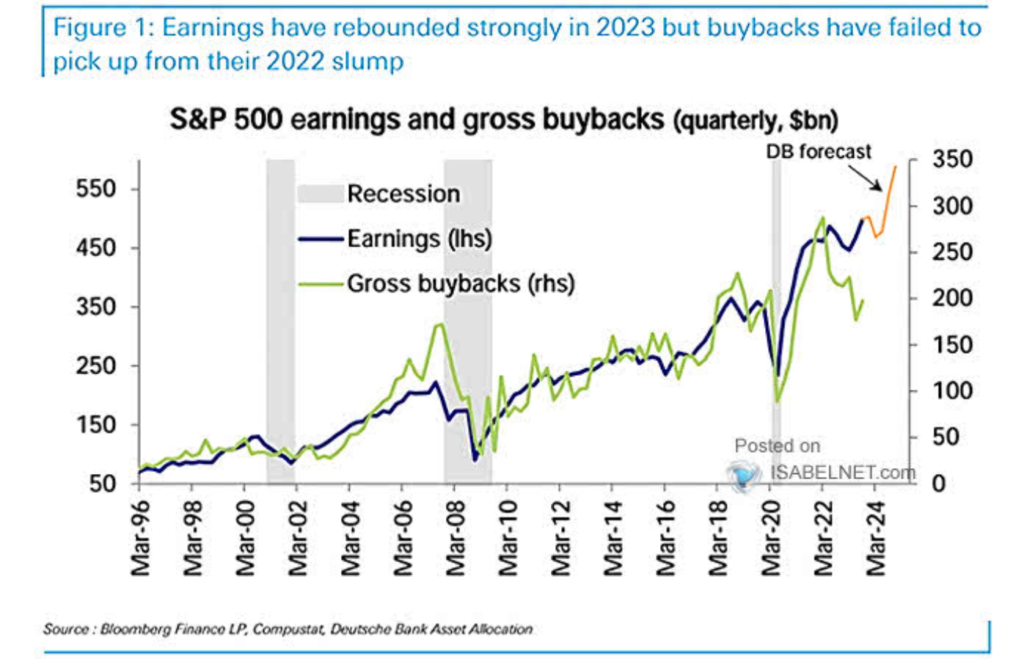

Whereas the bull market between 2009 and late 2019 was marked by relatively modest earnings growth relative to pre-Global Financial Crisis levels, S&P 500 earnings growth has been very robust since Covid – expanding more in the past four years than in the prior decade. Buybacks, on the other hand, are no longer following suit. Via Isabelnet:

🇺🇸 Buybacks

— ISABELNET (@ISABELNET_SA) January 17, 2024

Share buybacks will play a significant role in 2024, as they are set to accelerate once again amidst the ongoing improvement in corporate earnings

👉 https://t.co/Rk5tctMmih

h/t @DeutscheBank #markets #buybacks #sp500$spx #spx $spy #stockmarket #equities #stocks pic.twitter.com/XTOXBKg0mi

If the positive earnings outlook for 2024 holds up, buybacks are poised to roar back. Even in the more likely scenario that earnings disappoint, there is still room for buybacks to increase.

We have been describing our outlook as ‘purgatory’ for a couple years: constant fears of a recession but never the unambiguous recession that turns the page and markets which are range bound between the 2021 highs and the 2022 lows. While that model has worked quite well, it has been more than two years and we’ve now retraced almost fully to the 2021 highs. It’s time to watch and see if we can eclipse the old highs before getting wedded to one outlook or another.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.