Taps Coogan – July 22nd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

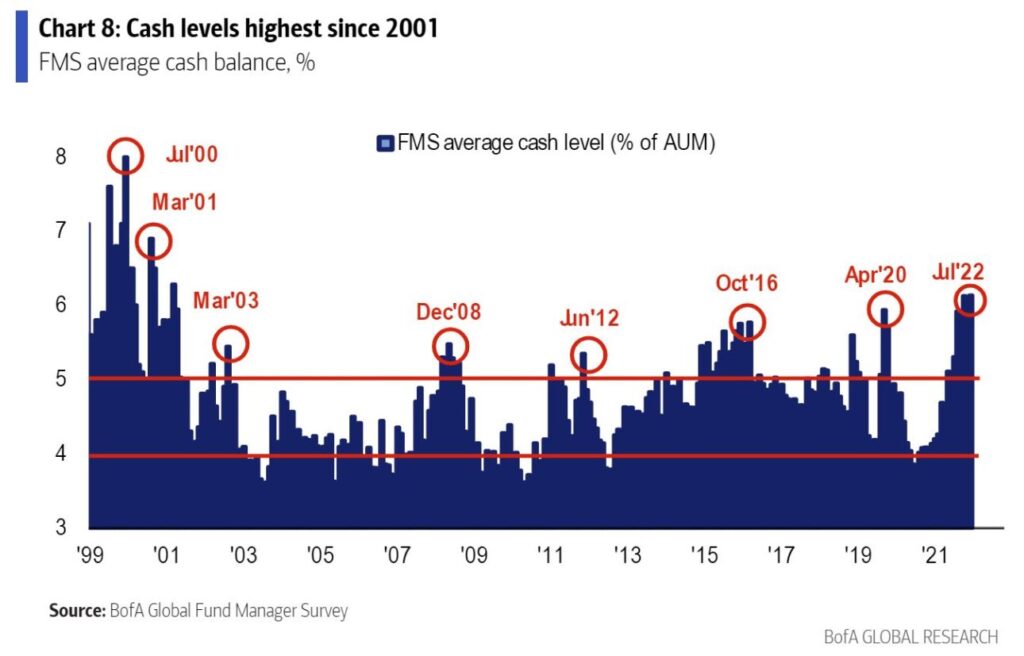

The following chart, via Callum Thomas, shows reported cash balances based on Bank of America’s well known Global Fund Manager Survey.

Fund managers are reporting their largest relative cash position since 2001 despite deeply negative real returns on cash owing to high inflation. They’re holding more cash (on a relative basis) than at the worst part of the Global Financial Crisis when some of the world’s largest financial institutions were failing.

To managers’ credit, that cash has been one of the least bad trades this year as the 60/40 portfolio is on track for its worst year ever.

With so much cash on the sidelines, and sentiment so universally negative, one has to at least entertain the possibility that the growth slowdown/recession we get ends up being of the milder variety.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.