Taps Coogan – February 24th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

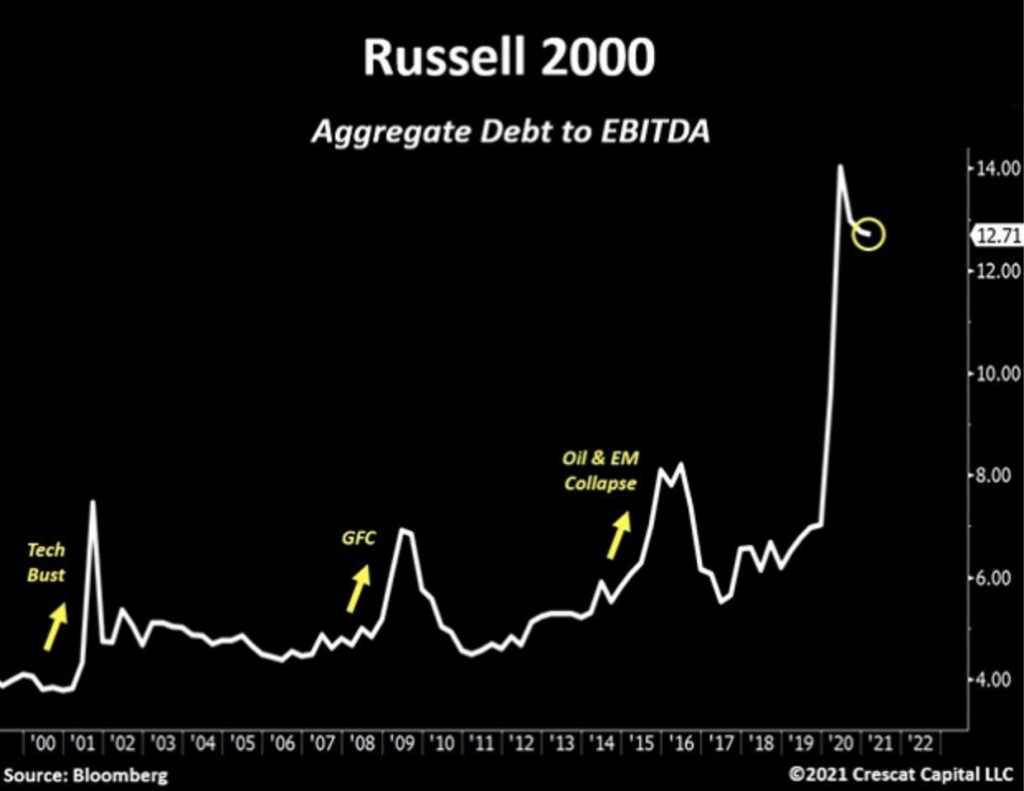

The following chart, from Otavio Costa of Crescat Capital, shows the ridiculous levels of debt that US public companies have taken on since Covid, relative to their EBITDA earnings.

Surges in corporate debt relative to earnings tend to happen during recessions when companies’ earnings fall faster than they can clean up their balance sheets.

Two of the three prior spikes (2001 and 2009) also occurred during brutal multi-year bear markets. The third spike (2015-2016) occurred when oil collapsed from over $100 a barrel in 2014 to $26 by 2016, producing a brutal bear market for debt-heavy oil companies and a stagnant period for markets more generally.

This time we have our recession. Stocks did crash for four weeks, though it hardly constituted the multi-year bear market seen during past analogies. Stocks are already back to stratospheric levels. Everyone has bought into the theory that the Fed can keep accelerating monetary stimulus and Congress can keep pumping out multi-trillion dollar stimulus bills as GDP accelerates to over 8% for the first quarter, inflation breakevens march past 2%, and the money supply growth hits Weimar Germany levels.

We’ve never had stocks hit record valuations in the middle of a recession. ‘This time’ really is different, at least in reference to post-war history. Of course, it is going to end badly all the same.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.