Taps Coogan – June 25th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

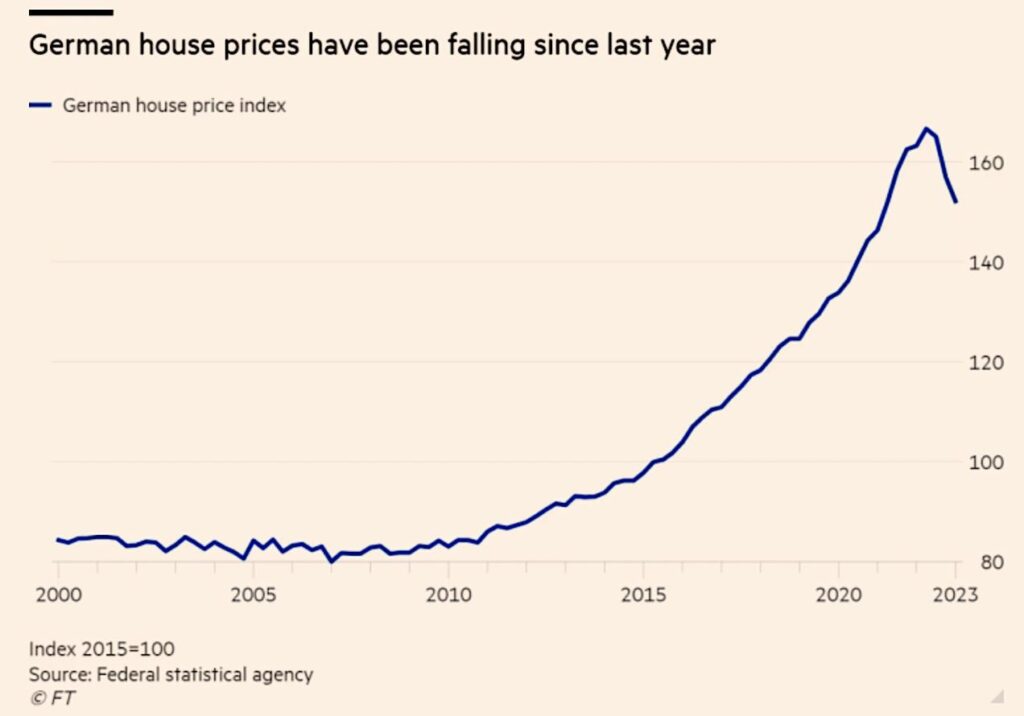

The following chart, from the FT via Holger Zschaepitz, should put fear into anyone who doubts that we’ve embarked on a long term real-estate valuation correction.

Population growth in Germany has been near zero for decades and is likely to stay that way, or shrink. The jump in home prices post-2010 was almost entirely a function of the emergence of ultra low mortgage APRs after the Global Financial Crisis.

Today, mortgage APRs are dramatically higher than the period from 2010 to 2022. In fact, they are roughly back where they were from 2000 to 2010 when home prices were much lower and showed no growth for a decade. Until interest rates fall again, home prices in Germany – and most of the West, still have quite a bit of correcting left to do.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.