In our recent article Margin Debt Hits an All Time High – Does it Matter?, we noted that margin debt growth on the NYSE is now outpacing stock price growth. While margin debt growth has not yet experienced the sort of surge that proceeded the 2000 and 2007 stock market highs, one appears to be in the making.

Enjoy The Sounding Line? Click here to subscribe for free.

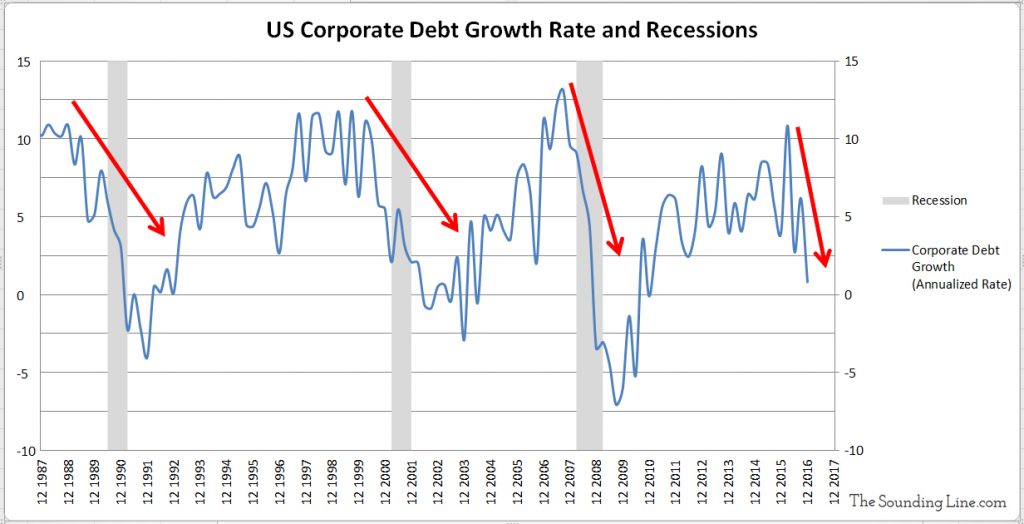

Today’s ‘Chart of the Day’ offers a more imminent warning. The decline in US Corporate debt growth since Q1 2016 is the largest to occur absent a recession going back at least as far as the 1990 Oil Shock recession. Hope for economic reform and political risks in the EU mean that the US is still the best game in town, but key underlying economic fundamentals are increasingly weak.

These figures are released quarterly so the most recent data point is from the last quarter of 2016. A lot will be riding on the 2017 Q1 economic figures.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.