Submitted by Taps Coogan on the 19th of September 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

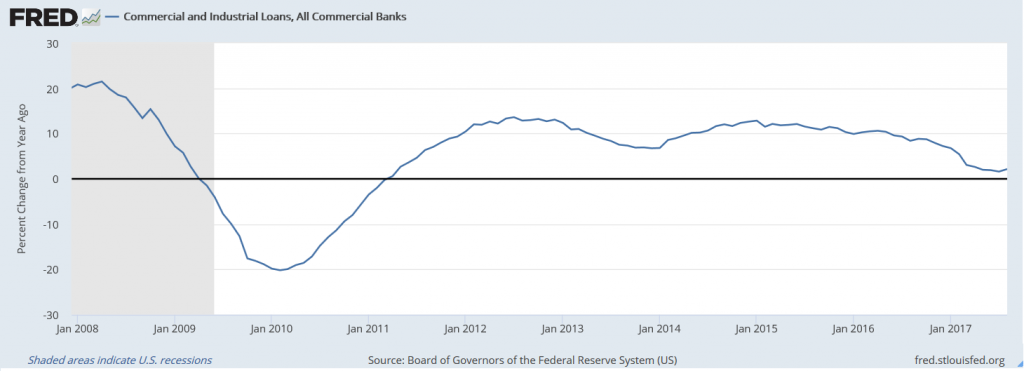

Commercial and industrial lending growth has continued to decelerate throughout the US economy. As the following chart shows, commercial and industrial lending is in the midst of its largest slow down since the 2008 recession. The slowdown began in January 2015, and has coincided with the Federal Reserve’s attempts to modestly tighten monetary conditions (an issue discussed in more detail by Dr. Lacy Hunt here).

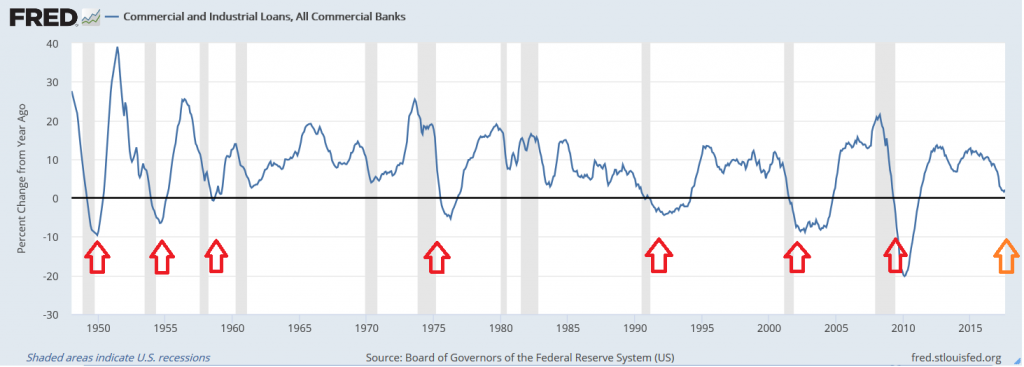

We have documented the slowdown in commercial lending several times here on The Sounding Line (here, here and here) because corporate and industrial borrowing is a critical measure of where the US economy stands relative to cycles of economic growth and contraction. As the following chart of year over year lending growth shows, this metric has turned negative during or immediately following every formal recession since 1948. Furthermore, at no point since 1948 has lending slowed to the level that is is at today and not subsequently turned negative amid a recession.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

This is a good post. Thank you.

Thanks for the kind comment