Taps Coogan – March 7th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

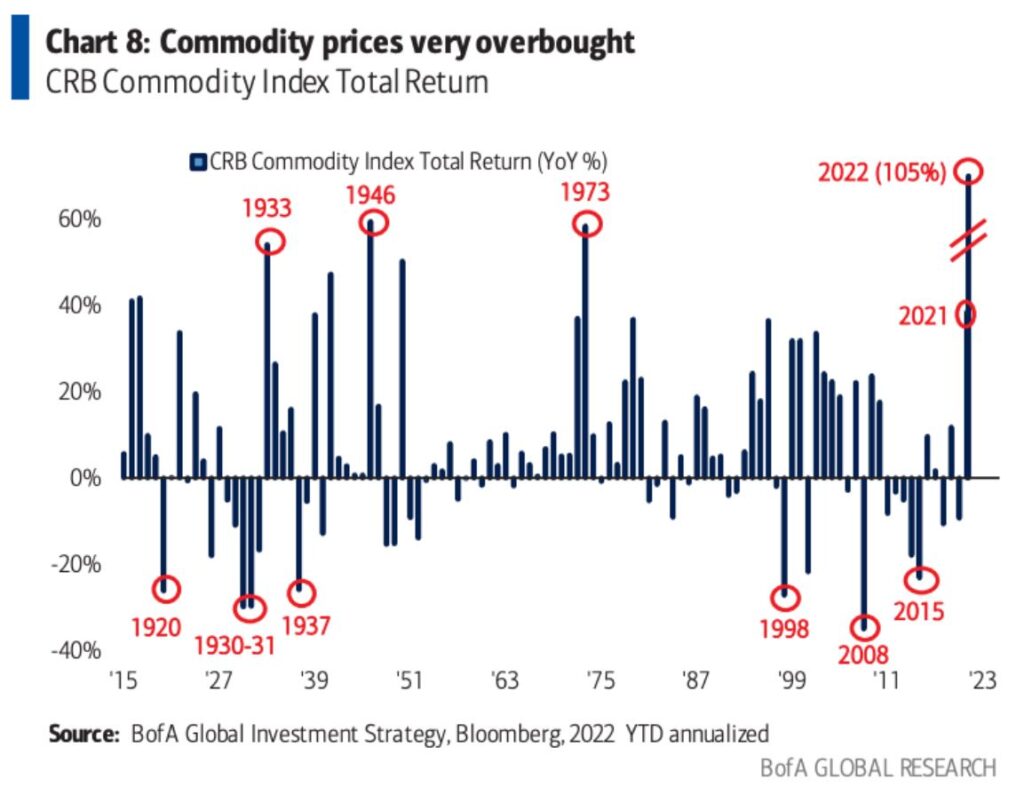

The CRB commodity index, one of the oldest commodity indexes, is on pace for the biggest year-over-year increase since at least 1915, a period which of course covers both world wars and the inflation of the 1970s, as the following chart from Bank of America via Andrew Thrasher highlights.

To be clear, this chart is taking the commodity price gains seen so far in 2022 and annualizing that pace for the full 2022. I normally wouldn’t give to much thought to a chart like this for that reason, however, while a case could have been made a few weeks ago that commodity inflation was likely peaking out, all bets are off since Russia’s invasion of Ukraine.

Indeed, this now looks like a perfect storm for commodities: decades of under-investment in natural resource development, green-dreams of commodity intensive grid-scale battery deployments and electric cars while simultaneously blocking every single large mining project needed to provide the materials for those dreams in the US (here, here, here, here, etc…), a genuinely incomprehensible US energy policy that has seen even up-and-running pipelines targeted for closure and a suspension and oil and gas permitting in the days after Russia invaded Ukraine, supply chain disruptions, and a now global hybrid and cyber war between the world’s largest consumers and one of the world’s largest resource producers.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.